tiger strawberry

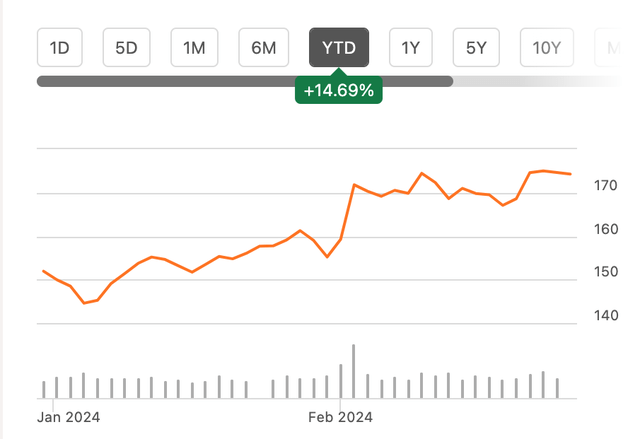

Following its final quarter (Q4 2023) and full year 2023 results on February 1, e-commerce giant Amazon (NASDAQ:AMZN) stock price rose by ~8%. This was his second-biggest single-day gain in the past year, taking his share price increase to 18%. I I wrote it last This is from November of last year. However, the stock price cannot be said to have finished its upward journey yet. Here are four reasons why Amazon is still his buy in 2024.

price list (Source: Seeking Alpha)

#1. Progress despite workplace accidents on Black Friday

Last time I wrote, the company was witnessing industrial action in 30 countries as employees demanded better conditions during the busy Black Friday sales day. Workers from other countries also joined members of the British Coventry warehouse union, which had been the most vocal in demanding better conditions, in a 28-day strike.

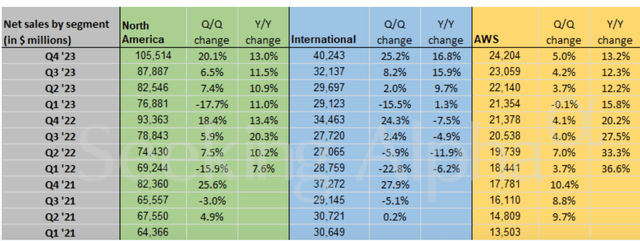

amazon revenue Growth by segment (Source: Seeking Alpha)

Even at that point, it was clear that a one-day strike was unlikely to impact Amazon’s numbers, but net sales growth at constant exchange rates for Q4 2023 (year-over-year It is worth noting that the ratio was slightly higher at 13%. International sales, in particular, accelerated to 13% in the quarter, compared to just 5% in Q4 2022, despite the segment’s efforts. It was reportedly even faster (see table above).

In fact, the company says this about this season:

We had record-setting Black Friday and Cyber Monday holiday shopping events…Over the entire holiday season, customers bought more items on Amazon than any other holiday season in history. ”

#2. Addressing the UK workforce challenges

But this is not to downplay the challenges that industrial action may still pose in the months and years ahead. The UK is particularly troublesome for Amazon, with more strikes occurring in Birmingham and Coventry in the first two months of 2024 alone.

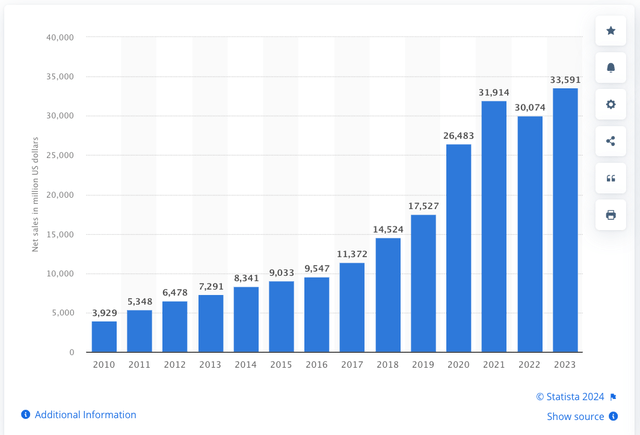

The market’s share of the company’s net sales in 2023 was approximately 6%, with UK sales increasing by 11%, in line with international sales growth. In other words, it’s an important growth market for Amazon, and the labor situation is one to watch.

Amazon UK revenue (US$ million) (Source: Statista)

In response, Amazon increased investment in its UK workforce by $170 million. The minimum starting hourly wage is expected to rise from US$12.3 to US$13 by April 2024, and the company has increased wages by 20% in the past two years. Although a step in the right direction, it remains to be seen whether this measure will be enough to reassure trade unions.

Moreover, the investment itself will not be significantly reflected in the company’s numbers, as it will account for only 1.3% of operating profit in Q4 2023. At the same time, the company is still losing money on its international sales division, so it will be important to see how this story develops. In fact, the segment’s operating losses increased sequentially from $100 million in the third quarter of 2023 to $400 million in the fourth quarter of 2023.

#3. Profitability and profit growth are expected to remain strong

However, for now, Amazon is positive about its operating profit margin, and it is expected to remain strong in the first quarter of 2024. The company’s sales forecast for the quarter is $138 billion to $143.5 billion, and its operating profit forecast is $8 billion to $12 billion. At the midpoint of the guidance range, the margin would be 7.1% (Q1 2023: 3.8%). This is slightly lower than his 7.7% margin in Q4 2023, but still better than his 6.4% level for all of 2023.

This can also be positive for a company’s net income after its earnings per share are diluted. [EPS] Full-year 2023 sales came in at US$2.9, beating analyst expectations of US$2.71. To estimate net income for 2024, we made the following assumptions.

- Revenues are expected to grow at an interim rate of 10.5% in the first quarter of 2024.

- The operating profit margin for the full year is expected to be 7.1%, the same as the previous fiscal year.

- Net income as a percentage of operating income is expected to remain constant at the 2023 level of 82.5%.

As a result, net income was $37.2 billion, an increase of 22.4% year over year. Analyst estimates available on Seeking Alpha are even more optimistic about EPS growth, with it expected to increase by 44.6% this year.

#4. Market multiple increases further

Following this, the forward non-GAAP price-to-earnings (P/E) ratio is now 41.7x, lower than the 55.3x the last time I wrote about it. My net income forecast is 48.6x, which is also lower than three months ago. The future P/E ratio is also lower than the company’s average of 185.5 times over the past five years.Similarly, non-GAAP trailing 12 months [TTM] The P/E ratio is 60.25x, but for the past five years it has been 83x.

What’s next?

Last time I was a little nervous about how Amazon would handle labor issues, even if the stock looked strong otherwise. There are two positive developments in this regard. First, the labor issue has not affected his 2023 Q4 results, and international sales in particular continue to show healthy growth. Second, it is taking steps to address labor issues in the UK, where industrial action is on the rise. It’s still a story to watch, as challenges may continue, but progress is being made in the right direction.

Even with increased investment in employees, the absolute numbers are small, and Amazon’s expected operating margins for the first quarter of 2024 look good. In fact, if this trend continues through 2024, the company could see solid revenue growth this year. This has led to its forward P/E ratio decreasing since I last checked, keeping it competitive compared to its historical average.

In summary, there’s nothing wrong with Amazon’s story. Quite the opposite. I will continue to buy stocks.