Magnificent 7 Are tech stocks still great? That’s the big question for investors right now. These tech giants were at the forefront of last year’s stock market boom, but some are hitting roadblocks this year. That’s nearly double the Nasdaq’s 54% growth in 2023, but some of them now appear to be above their all-time highs.

But this is not the end of the road for Mag 7. Rather, it serves as a reminder for investors to exercise caution and conduct thorough research before taking action. These companies boast impressive advantages, from dominant market positions to deep financial reserves and superior product offerings. There’s no denying why they rose to the top. And while some companies may be slowing, others are still rising, suggesting there are still solid opportunities in the big-cap tech sector.

Tom Forte, a 5-star analyst who watches technology giants at investment research firm Maxim and ranks in the top 2% of stock experts on the Street, believes that Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) I investigated the inside of both. ), two of the names of the Magnificent Seven. His analysis draws clear conclusions about which of these stocks to buy. Let’s take a closer look.

Amazon

Let’s start with Amazon, a company that wears many hats. The company holds the title of the world’s largest online retailer and functions as a technology company deeply committed to AI, cloud computing, and online services. Additionally, Amazon is a giant by many measures, with a market capitalization of $1.89 trillion.

Retail remains Amazon’s core business. The company can deliver most of its products to customers within 1-2 days. To help with this, Amazon has built a network of physical distribution centers known as “fulfillment centers” that can quickly process and ship orders around the world. In calendar year 2023, the company achieved total revenue of $574.8 billion.

Amazon may be the world’s leading e-commerce company, but that’s not all. The company has taken an online approach and applied it to a wide range of customer services, including its cloud computing service AWS, home automation, e-books, TV streaming, online gaming, and even grocery ordering. As a final note, Amazon plans to make the Dash Cart technology, currently available online at Whole Foods and Amazon Fresh stores, available at select third-party grocery retailers.

Turning to AI, Amazon has made a significant investment in generative AI company Anthropic. With a total investment of $4 billion, Anthropic is working on generative AI technology with support from Amazon. Amazon’s proprietary serverless platform, Bedrock generative AI technology, is used by BrainBox to develop and launch its virtual architectural assistant. These examples are just the tip of the iceberg. AI is the next big thing in technology, and Amazon is making sure to position itself at the forefront.

Amazon’s next quarterly report (Q1 2024) is expected to be released later this month. The Street expects it to top out at $142.59 billion. Looking back at Q4 2023, Amazon’s quarterly revenue was $170 billion, representing 14% year-over-year growth and beating expectations by $3.74 billion. His cloud computing arm AWS contributed significantly to the overall, recording 13% year-on-year growth and accounting for his $24.2 billion in total revenue. International sales led revenue growth, increasing 17% year over year to $40.2 billion. The company reported a bottom line profit of $10.6 billion, or $1 per share.

Analyst Forte said Amazon has been following the vision of its new CEO in recent years, and this path has been successful. He writes about the company: “Since assuming the role of CEO in July 2021, CEO, President and Director Andy Jassy has done an excellent job of developing and executing his vision for the future. We are reevaluating the stock price with a focus on the future, which may result in improved profit margins. The company already trades at a significant P/E premium compared to big tech companies. If trading at a deep discount, there is a significant opportunity to close the gap with peers on an EV/Sales and EV/EBITDA basis. The company will be able to narrow this large valuation gap by increasing sales from high-margin services and decreasing sales from lower-margin retail sales (including potentially due to defocusing of groceries). There is a possibility that it can be filled. ”

In summary, Mr. Forte comes down to a bullish statement. “We value the company at 17.5x EV/EBITDA (compared to the current 15.0x), with an average of 26.7x, and higher earnings, with the expectation that it will close the gap with big technology companies. You can increase your revenue by increasing your rate.”

To this end, Forte rates AMZN stock a Buy, and his $218 price target suggests a 20% one-year upside potential. (Click here to see Forte’s track record)

Overall, there have been 41 recent analyst reviews on Amazon stock, and the consensus is that it’s a Strong Buy stock. The stock is priced at $181.28, and the average price target of $212.21 suggests the stock has 17% upside potential for the year. (look AMZN stock price prediction)

apple

Next up is Apple. This is also his one of the great 7 high-tech companies, and on Wall Street he is the second largest publicly traded company. Apple was the first publicly traded company whose market capitalization reached his $1 trillion, the first to reach $2 trillion, and then the first to reach $3 trillion. The stock has had its share of ups and downs, and the company currently has a market capitalization of $2.61 trillion. In the company’s 2023 fiscal year, which ended last September, Apple had total revenue of $383 billion and net income of nearly $97 billion.

Apple has achieved success through developing, producing, and marketing “things that people like,” and has reached the pinnacle of the technology world. From the early PCs to the development of the Mac series and later his iPhone and iPad, Apple has excelled at bringing high-end technology products to market with a great combination of style and functionality.

But recently, Apple has faced headwinds. The company has become heavily dependent on iPhone sales. This is evident in the first quarter financial statements of FY24, which showed that the iPhone division accounted for over 58% of the company’s total net sales.

If Apple were not so dependent on China as both a supplier and market, its high dependence on iPhone products would be less of an issue. The company sources most of its parts and components from China, and weak demand for smartphones there is also putting pressure on Apple. According to some industry reports, the company saw its sales in China drop by 24% earlier this year. According to Apple’s FY24 Q1 report, the company’s overall sales in China decreased by about 13% in the same quarter. What is noteworthy here is that his Apple’s China sales in the first quarter accounted for more than 17% of the company’s total revenue.

If we zoom out a bit, we can see that Apple reported a high of $119.6 billion in the first quarter of fiscal 2024. Despite the headwinds, he beat expectations by $1.34 billion, up just 2% year over year. The company’s EPS was $2.18, 7 cents better than expected. However, concerns have persisted among investors, with AAPL stock down as much as 13% since the beginning of the year.

In a report on Apple, top analyst Tom Forte acknowledged the company’s strengths, but said the current situation is far from favorable. The challenges are: 1) Apple is too dependent on China in terms of sales. (18.9% in FY2023) and supply chain perspective. 2) Regarding short-term performance, a single product, the iPhone, has a high proportion (52.3% in FY2013). 3) We monitor a list of items that could contribute to longer dead money periods in stocks, including antitrust/regulation, consumer electronics demand imbalances, and competition. ”

To this end, Forte rates Apple stock a Hold, with a price target of $178, suggesting a modest 6% upside this year.

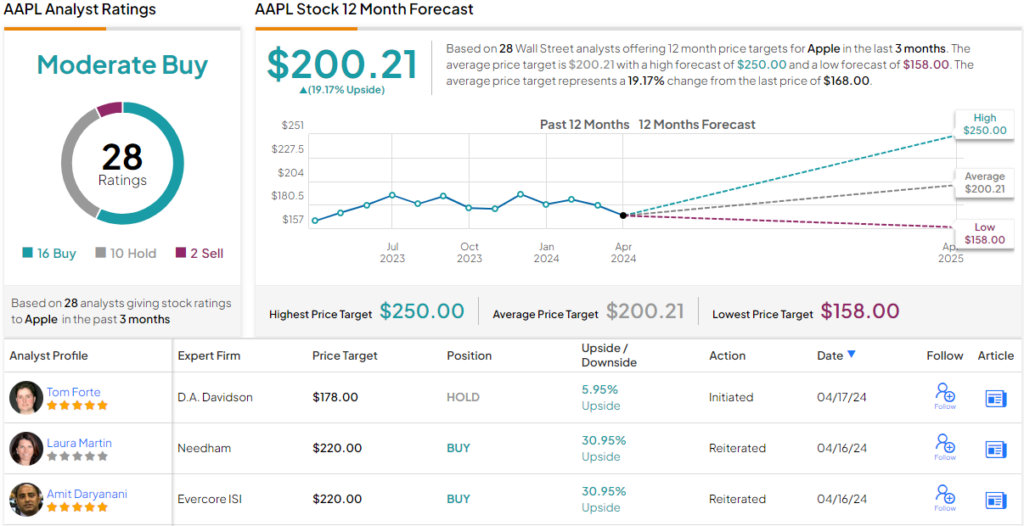

Overall, Apple receives a Moderate Buy rating from the Street. This is an opinion based on 28 recommendations, including 16 Buy recommendations, 10 Holds, and 2 Sells. Apple stock is currently trading at $168, and the average price target of $200.21 suggests a one-year upside of 19%. (look Apple stock price prediction)

After examining the data and considering analyst positions, it’s clear that Maxim’s Tom Forte believes Amazon is the best stock to buy now among the Magnificent 7.

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.