Tech giant Apple’s stock price (NASDAQ:AAPL) has fallen today, but this may be due to analysts’ comments. Interestingly, Needham’s Laura Martin reiterated her own Buy rating while setting her price target at $220 per share. However, she lowered her forecast for the second quarter, citing problems in China and weak iPhone sales.

Martin now expects sales of $90.8 billion and earnings per share of $1.51. Compared to her previous predictions, the latest numbers put the former 4% lower and the latter 7% lower. She believes Apple’s growth prospects are “poor” and that expenses will rise as the company ramps up investment in artificial intelligence.

Is Apple a buy, hold, or sell?

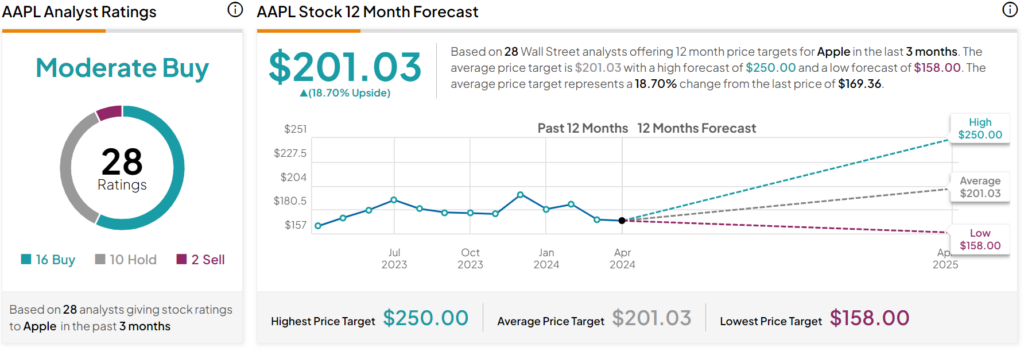

Overall, analysts give Apple stock a consensus rating of Moderate, based on 16 buys, 10 holds, and 2 sells assigned over the past three months, as shown in the chart below. It is said to be a moderate purchase. After declining 12% year-to-date, AAPL’s average price target of $201.03 per share suggests 18.7% upside potential.

Is it wise to allocate $1,000 to AAPL stock right now?

Before you rush to invest in AAPL, consider the following:

The team at TipRanks has built a portfolio of top stocks for investors, and Apple isn’t included. Our portfolio highlights carefully selected companies that have the potential to deliver significant returns in the coming years.