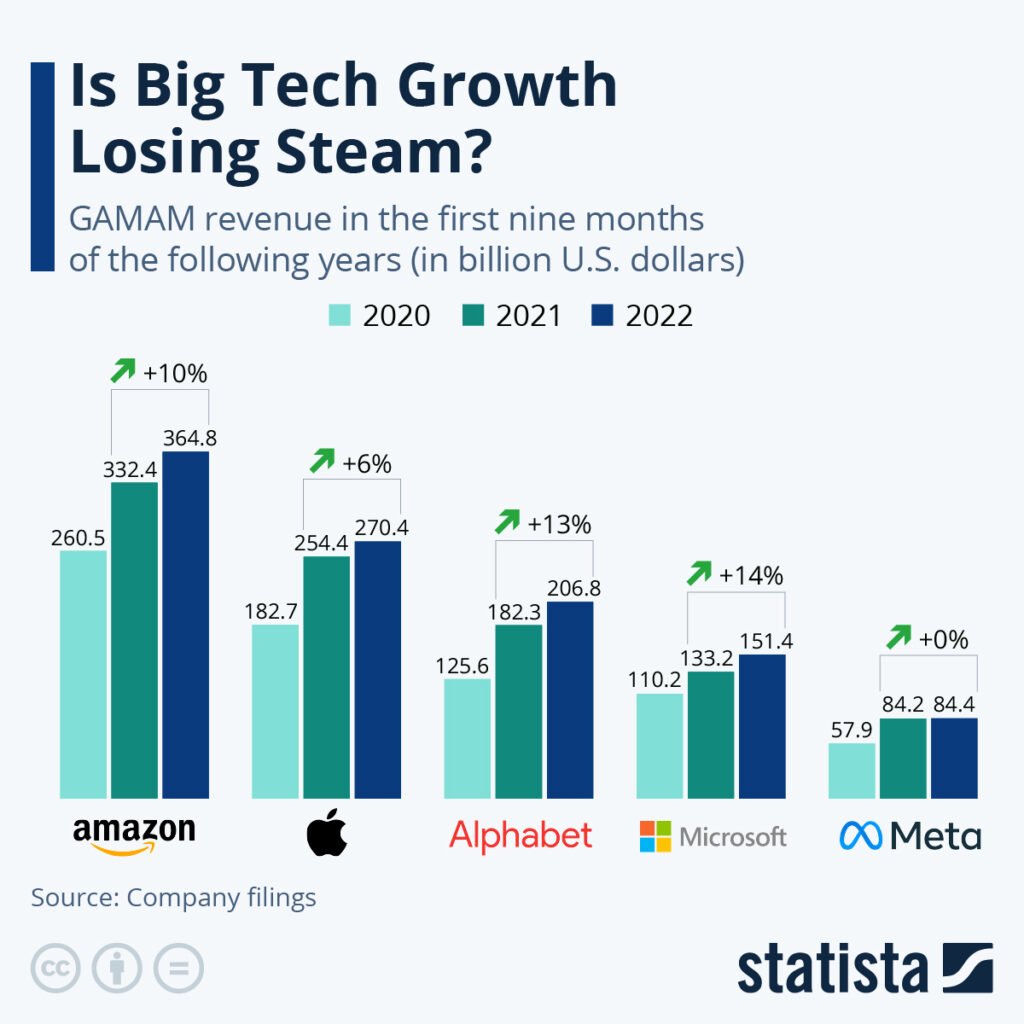

The first two years of the pandemic were extremely profitable for tech giants like Amazon and Meta, with revenues growing 20-45% year-over-year when comparing 2020 with the first nine months of 2021. Now, the current geopolitical situation, rising inflation, a looming recession, and China’s strict zero-COVID strategy that will hinder production in the first half of 2022 have dealt a blow to the incredible growth surge of GAMAM (Google, Amazon, Meta, Apple, Microsoft).

As the chart shows, Meta took the biggest hit in terms of revenue growth, increasing by just $200 million in the first three quarters of 2022 compared to the same period in 2021. This development can be traced back to increased investment in Mark Zuckerberg’s metaverse initiative, which the company is unlikely to recoup in the near future.

Apple suffered a similar blow, despite releasing new Watch and iPad models in early 2022 and bringing its iPhone 14 product series to market just before the end of its fiscal year: Revenue grew 39% from 2020 to 2021, but this year concerns about financial constraints due to rising energy and oil prices likely impacted consumer spending, leading to just a 6% increase in revenue.

Meanwhile, Alphabet and Microsoft performed best in their GAMAM divisions, posting revenue growth of 13 percent and 14 percent, respectively. One of the key drivers of this development is the continued demand for robust cloud solutions. Alphabet also saw continued growth in its Google Search segment, although revenue from YouTube advertising declined year-over-year.

With growth in the tech sector slowing, it’s only a matter of time before GAMAM as a whole starts implementing cost-cutting measures, such as laying off staff. After Twitter laid off half of its employees in an attempt to turn the social network into a profitable business, Meta has already followed suit. On November 10, the company announced it would lay off 11,000 employees, or 13% of its global workforce.