Image credits: Nasir Kachlou/Nurfoto/Getty Images

The National Payments Corporation of India (NPCI), the governing body that oversees India’s widely used Unified Payments Interface (UPI) mobile payments system, this month collaborated with various fintech startups to improve PhonePe’s dominance in the market. We will develop strategies to deal with the expansion of power. Google Pay within the UPI ecosystem.

NPCI executives met with representatives from players such as CRED, Flipkart, Fampay and Amazon to discuss key initiatives aimed at facilitating UPI transactions on their respective apps, people familiar with the matter told TechCrunch. He told TechCrunch that he plans to discuss the company’s efforts and understand what support is needed.

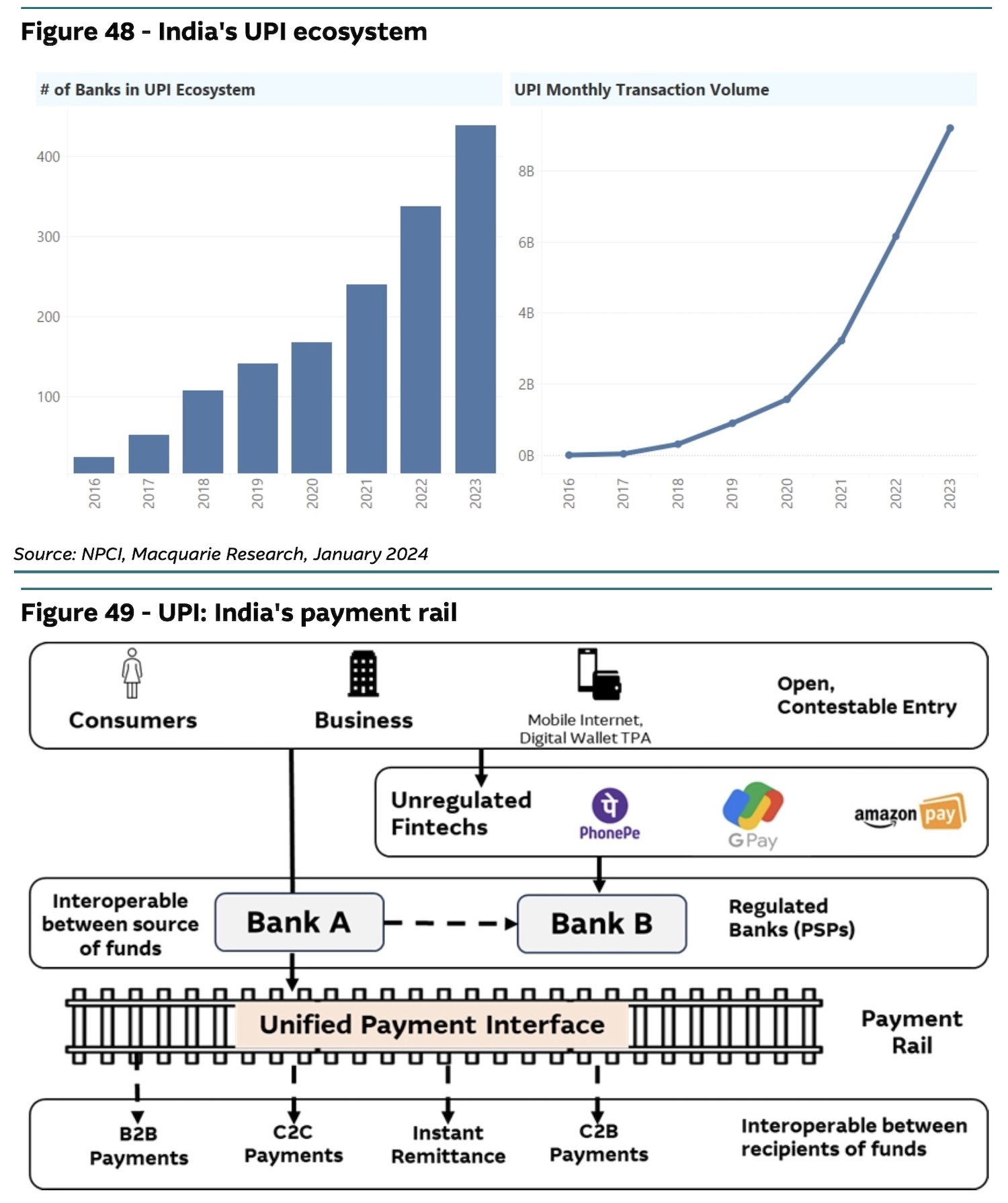

UPI was built by the Indian Banking Confederation and has become the most popular way for Indians to transact online, processing over 10 billion transactions every month.

The new meeting is part of an effort to address concerns raised by lawmakers and industry stakeholders about the concentrated market share of Google Pay and PhonePe, which together accounted for nearly 86% of UPI transaction volume and had a This is an increase from 82.5%. December. Walmart owns more than three-quarters of PhonePe.

Paytm, No. 3 in UPI, saw its market share fall to 9.1% by the end of March from 13% at the end of 2023 following a crackdown by the Reserve Bank of India (RBI).

An overview of the UPI ecosystem in India. (Image: Macquarie)

The meeting comes after the central bank expressed its “displeasure” to the NPCI over its growing monopoly in the payments sector, a person familiar with the matter said. A spokesperson for NPCI declined to comment.

In February, a parliamentary committee in India called on the government to support the growth of domestic fintech companies that can offer alternatives to the Walmart-backed PhonePe and Google Pay apps.

NPCI has long advocated for capping the market share of individual companies participating in the UPI ecosystem at 30%. However, the deadline for companies to comply with the directive has been extended to the end of December 2024. The organization faces unique challenges in implementing this Directive. TechCrunch previously reported that it believes it currently lacks the technical mechanisms to do so.

Another official said the RBI is also considering incentives to create a more favorable competitive environment for emerging UPI players. Indian daily Economic Times separately reported on Wednesday that NPCI is encouraging fintech companies to offer incentives to users and promote the use of their respective apps for making UPI transactions.