Software giants are making big profits in the cloud, and could be a big bet on research into quantum computing.

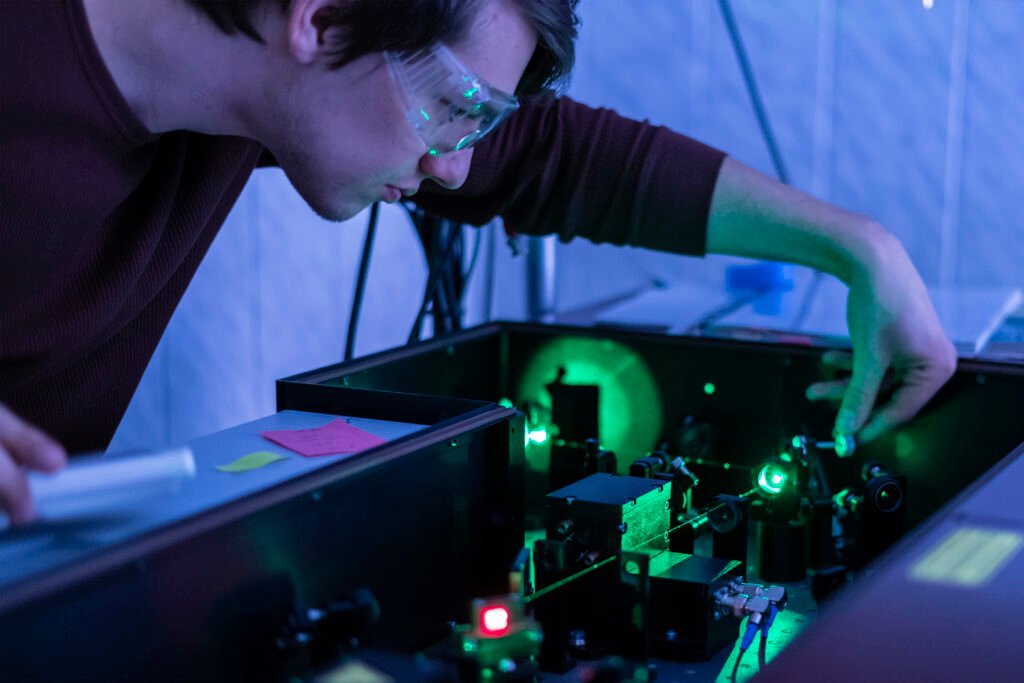

As large-scale artificial intelligence (AI) systems scale up, some investors are already pinning their hopes on what could be the next technology breakthrough: quantum computing. There’s a reason for that. Companies developing quantum hardware (which uses qubits to replace the classical computing bits, the binary ones and zeros that currently underlie all software code), are using subatomic I need a way to perform error-free calculations at scale.

After all, large-scale AI data centers microsoft (MSFT -1.84%) is under construction, but it can do just the right trick to make a quantum computer run error-free.

Microsoft recently jointly announced a breakthrough with Quantinuum, a startup majority-owned by the industrial giant. honeywell (Hon 0.38%). Is Microsoft the best candidate in this small, research-driven industry?

What are Microsoft’s most promising developments to date?

I recently wrote about how quantum computers are being developed. Nvidia‘s (NVDA 0.76%) Accelerated computing and AI systems. Specifically, Nvidia has been partnering with startups and researchers to create a hybrid model of classical computing that will help develop the next generation of quantum computers. Significant hurdles remain on the path to widespread commercialization of quantum computers. These hurdles include everything from the hardware that creates the qubits used in quantum computing to the encoding of the software itself. Who better than his Nvidia, with its cutting-edge AI platform, to help overcome these hurdles?

One of the major customers for Nvidia’s AI systems is Microsoft, which has been working on building quantum computers for years. Not coincidentally, the company also offers quantum research and development (R&D) services via its Azure cloud platform, including a hybrid of classical quantum computers that helps quantum computers correct computational errors.

It was with this hybrid computer architecture that Quantinuum achieved a breakthrough in computer calculation error correction.

Just as advances in classical computers required cramming more transistors onto each chip (think Moore’s Law), quantum R&D is rapidly increasing the reliability of what quantum machines can perform. We are working on increasing the number of high qubits. However, measurements of these qubits can be disrupted by all sorts of environmental influences. By applying a classical quantum hybrid that uses powerful AI to “virtualize” qubits, Quantinuum can better analyze hardware designs virtually and improve performance when performing computations on quantum hardware. They say they were able to reduce the error rate by a factor of 800.

Next step: big returns for investors?

To be clear, researchers still need to do a lot of work to pave the way for the widespread use of quantum computers. In addition to further research and development into reliable hardware, the software that runs on those computers must be coded. This is why big AI leaders like Microsoft and AI systems developers like his Nvidia may actually be the best way for investors to bet on quantum computing right now.

In the meantime, Quantinuum will continue its hardware roadmap, turning to cloud and AI providers like Azure for help along the way.

Quantinuum is privately owned, so direct investment is not possible. However, Honeywell owns about 54% of the startup, which could make it worthy of investors’ attention. If Quantinuum can win enough and bring quantum computers to market, Honeywell shareholders could stand to make a big profit. For now, file this away as a long-term bet rather than a surefire path to quantum computing riches.

Nevertheless, with all the big technology companies getting into the quantum computing R&D game, it is currently up to one of their research partners, such as Microsoft, Quantinuum, or another company, to decide who wins the race. It’s difficult to do. For most investors, the best way to bet on future exponential steps in computing acceleration is to simply own a diversified basket of big tech stocks and give those companies what they need to do over the long term. It might be something to do.

Nicholas Rossolillo and his clients have positions at Nvidia. The Motley Fool has a position in Microsoft and He recommends Nvidia. The Motley Fool recommends Intel and recommends the following options: Long January 2025 $45 Calls on Intel, Long January 2026 $395 Calls on Microsoft, Short January 2026 $405 Calls on Microsoft, and $47 May 2024 Calls on Intel. It’s a short call. The Motley Fool has a disclosure policy.