META long term trading plan

- Buy META just above the target of 453.05. n/a stop loss is 451.74.

- none .

META swing trading plan

- Buy META just above 492.91, no target, stop loss @ 491.49

- Short META is slightly closer to 492.91 with target at 477.14 and stop loss at 494.33.

META day trading plan

- Buy META just above 492.91, target 496.41, stop loss @ 491.76

- Short META is slightly closer to 492.91 with target at 482.51 and stop loss at 494.06.

Real-time updates are available at: Meta Platforms Co., Ltd. (Meta) Page is here: Meta.

META Ratings for February 28th:

| Period → | near | mid |

length |

|---|---|---|---|

| evaluation | strong | strong | strong |

| P1 | 0 | 0 | 373.86 |

| P2 | 482.51 | 477.14 | 412.51 |

| P3 | 496.41 | 492.91 | 453.05 |

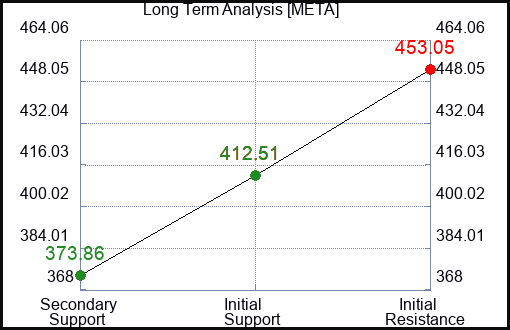

META support and resistance plot chart

Blue = current price

red = resistance

green = support

Real-time updates for repeat institutional readers:

Instructions:

-

Under[リアルタイム更新を取得]Click the button.

-

At the login prompt, select “Forgot your username?”

-

Enter the email you want to use for FactSet

-

Log in using the user/pass you received

-

Access real-time updates 24/7.

Under[リアルタイム更新を取得]Click the button.

At the login prompt, select “Forgot your username?”

Enter the email you want to use for FactSet

Log in using the user/pass you received

Access real-time updates 24/7.

From then on, you can always get real-time updates with just a click.

Get real-time updates

Our market crash leading indicators are:Evital Corte.

-

Evitar Korte has warned of the risk of a market crash four times since 2000.

-

We identified the internet disaster before it happened.

-

We identified the credit crunch before it happened.

-

Corona shock was also identified.

-

Check out Evitar Corte’s comments.

Get notified when ratings change: Try a trial version

transaction Meta Platforms Co., Ltd. (NASDAQ: META) can be an efficient and profitable trade, especially in volatile markets, as long as the stock’s key pivot points are observed before making a buy, sell, or short decision.

caveat:

This is a static report and the data below is valid at the time of publication, however META support and resistance levels change over time and the report should be updated regularly. Real-time updates are provided to subscribers. Unlimited real-time reports.

Subscribers also receive market analysis, stock correlation tools, macroeconomic observations, timing tools, and market crash protection with Evitar Corte.

Instructions:

Instructions:

The rules that govern the data in this report are technical analysis rules. For example, if META is testing a support buy signal, resistance is the target. Conversely, if resistance is being tested, it is a sign to control risk or short, and support will be a downside target accordingly. In either case, the trigger point is designed to be an ideal place to enter a position (avoiding trading in the middle of a trading channel) and also serves as a level of risk control. Masu.

Swing trading, day trading, and long-term trading plans:

This data has been refined to distinguish between day trading, swing trading trading plans, and META’s long-term investment plans. All of these are displayed below the summary table.

Basic chart of META: