photograph

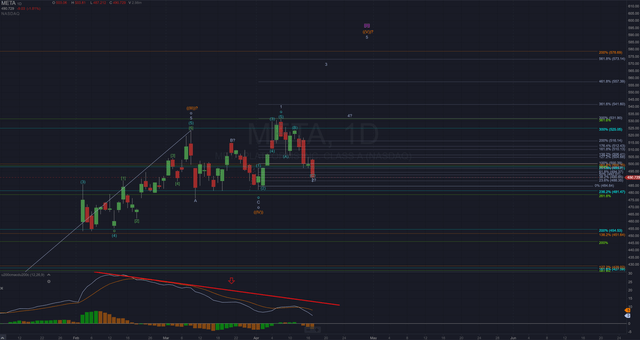

What if any company had a better vision and execution of AI from a capabilities and product perspective than Meta Platform?Nasdaq:Meta), I don’t know them. I’ve been touting Meta as one of his leading AI “retail” companies., which not only uses AI to improve user engagement, but also showcases the power of ad targeting and ad analysis systems. The company has relegated itself to being a true integrated AI company, where others at its level have yet to make the leap. With this great AI execution, growth and cash flow have never been better, and looking to the future, nothing could be better. But the problem lies outside the walls of the executive suite. My concern is not with the company’s growth prospects, but with its graph.At the end of the day, I understand that stock prices ultimately matter to investors. it’s coming A ceiling can lead to retracements and consolidations that can last for months or quarters.

I’ve been slamming the meta platform table for most of 2023 and all of 2024 so far. I’m up about 73% since his August call touting Meta’s AI superiority, so the returns speak for themselves. Additionally, in the new year, I emphasized that this business was undervalued and that estimates would be revised significantly upwards as the quarter began. I still expect this to be the case, as the analyst’s EPS estimate of $20.02 lags mine. Before-4th quarter earnings report estimate of $21.79.

But my admittedly conservative price target of $435 has had to be waved as it passes, so a stock in the low-to-mid $500s is not only causing a change in valuation; Probably hitting the top of the chart expectations. This doesn’t mean the company’s Q1 earnings report next week can’t further spur the stock towards the mid-to-high $500s, but it would be an area where I would further reduce my long position.

great fundamental outlook

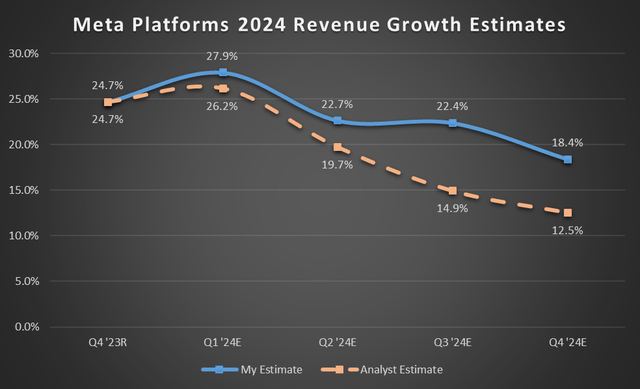

Great growth prospects for 2024 have been floated a lot and I’m confident in my predictions, but stock prices don’t always have to align with fundamentals, and often they don’t. If I estimate annual earnings growth as low as 20%, my EPS estimate for him would be surprising. Since January, EPS has increased to his $22.34. Here’s where I stand on this year’s earnings compared to analysts.

My graphs, data from Seeking Alpha, and my estimates.

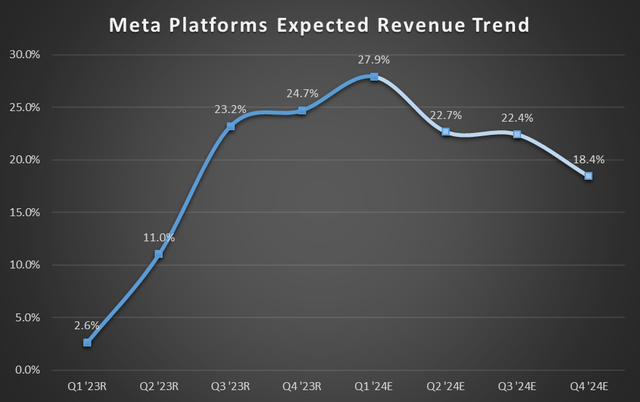

The bearish angle sees growth slowing after a steady acceleration in 2023 (see below). From a fundamental perspective, this could lead to selling pressure.

My graphs, data from Seeking Alpha, and my estimates.

The company’s AI prospects, which I touted last year, are still very much in play and will continue to gain traction across the digital advertising industry in 2024. Some tailwinds give me confidence on the upside as the company continues to strive to bring Reel to mature inventory levels and monetize it. It’s unlikely that forecasts will have to be revised upwards after next week’s earnings report.

very fair review

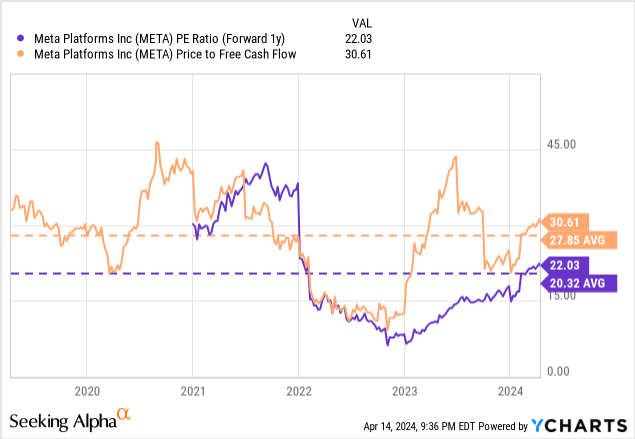

Basically, please check. Currently, valuations require caution.

And its valuation remains on the low-risk side of tech investments, rising above its five-year historical average in the past two months.

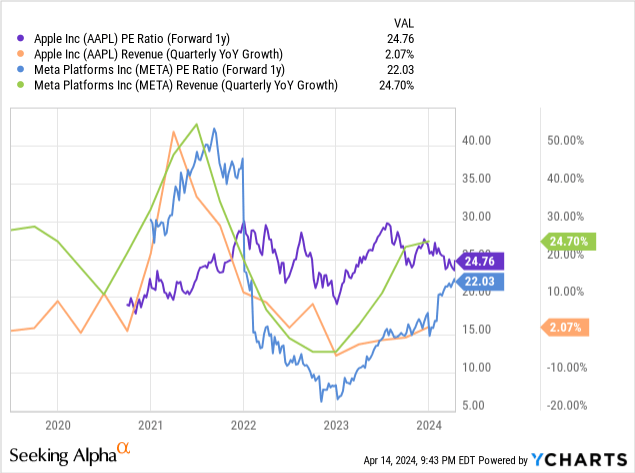

This isn’t a dire situation for a valuation, considering that many other stocks have growth rates that are much lower than Meta’s mid-20% top-line growth rate. Case in point: Apple (AAPL), low single digit growth but high valuation.

However, the meta is now moving into more historically fair valuation territory despite my calculated outperformance. Based on these estimates and evaluations, you could file a lawsuit for $560 to $600 over the coming weeks and months. Using my latest EPS estimate, even at $600, the stock would be trading at a forward P/E of 27, which is in line historically.

But looking at the charts, it seems less certain that it will return for the rest of 2024.

Fundamentals look very bullish, even though revenue growth may be slowing and valuations are still relatively fair, but the chart suggests bulls may be reaching a depletion point It suggests that there is. It appears to be losing momentum as the fundamentals haven’t improved as much as expected as they did in the second half of last year.

This isn’t to say that Meta can’t rise a bit more on the back of a great earnings report and improving outlook. Because while it is possible (and it looks like it will be), the chart is in a zone where the upside is likely to rise. It is being formed. And this top may not last just a few weeks or even months. It might be the end of the year already. The upside is that this long-term correction will eventually give way to a setup that could push him significantly higher than all-time highs, perhaps in 2025 and 2026.

In the short term (e.g. earnings next week and the week after that), the meta is on track to rise further to $580-$600. So far, there have been 5 waves up from the lows of wave (IV) and wave 2 of (V) has a corrective 3-wave pullback, so there is a pretty good chance of a rally after earnings. . This completes the entire wave I structure, reaching the expected 200% Fib elongation based on the lower-order wave pattern.

chart mine

Additionally, the MACD chart (indicated by the red line) has begun a bearish divergence ahead of the top of wave (III), indicating that the MACD is nearing the end of the secular bull market. Therefore, this lends credence to the possibility that this could be the last bull market to reach all-time highs for most or all of 2024. And it seems like the more we look at the timing of earnings, the more that might become apparent. (V) Wave 3 catalyst.

So, while the short-term trajectory appears to be upwards, there is nothing that hasn’t been exceeded yet, so be cautious. This is why I have been advising my subscribers to slowly scale out their long positions to take profits during the rise.

Use all tools and methods

Now before you think I’m bearish on the entire meta, I’m not. The company’s business and fundamentals look very strong next year. However, based on the chart, upside for the rest of 2024 doesn’t seem all that certain, even though the fundamentals and valuation could indeed support something up to $600. Considering the fundamentals, valuation, and the overall chart picture, we will move to Hold and adjust if it approaches $600.

If what I expect plays out over the long term, I plan to re-enter the long position at a much lower level in the second half of 2024. It all depends on where it tops out, but it will likely be a 40% to 50% retracement of the bull market from November 2022. The probability is low.