derrick hudson

Metaplatform (Nasdaq:Meta) is scheduled to begin earnings for the company’s March 2024 quarter on April 24, after the market closes, and I’m bullish on earnings. In my view, Metaplatform’s upcoming quarterly report will show the following: A variety of alternative data tracked by major investment banks highlights both the expansion of ad wallets and Meta’s increasing market share within those wallets, which is causing ad revenue to soar. At the same time, download tracking and research suggest that Meta’s Instagram platform is showing solid growth and increased engagement. Finally, I expect Meta management to gain momentum in building and integrating his GenAI capabilities across his social media empire, which could drive a new commercial growth cycle in the coming years. there is. On the back of a favorable risk-reward bias coupled with strong commercial momentum in Q1 results, I upgrade and set Meta stock to ‘buy’. Target price is $600 per share (in line with valuation levels of other major AI players such as Microsoft, with an EV/EBIT multiple of approximately 25x)28x EV/EBIT) and Nvidia (25x EV/EBIT).

Context: Meta stocks have significantly outperformed the broader U.S. stock market year-to-date. Since the beginning of the year, META stock is up about 36%, while the S&P 500 (SP500) is up about 4%.

In search of alpha

Strong advertising momentum drives sales growth

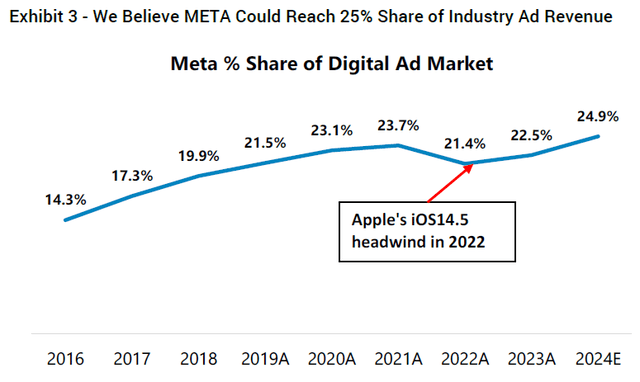

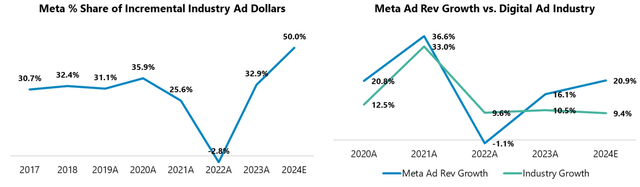

Strong advertising momentum appears to be so strong heading into 2024 that we expect Meta’s first quarter 2024 revenue to be at the high end of the company’s guidance of $34.5 billion to $37 billion. There is. We spoke to seven market participants with discretionary spending authority over advertising budgets (mostly small and medium-sized businesses) and found that macro-level advertising spend in Q1 2024 will increase by 10-15% year over year. I am guessing that it is possible. And in this supportive backdrop, Meta is expanding its share. According to a Jefferies research report, in 2024 Meta is expected to capture his 25% share of the digital advertising market and a breathtaking 50% share of the industry’s incremental advertising spend. This is a significant increase from before. 33% in 2023. In that regard, it is worth highlighting that Meta has shown rapid recovery and growth following the initial impact of iOS14.5 privacy changes, outperforming its competitors for five consecutive quarters (Source: Jefferies Research Note dated April 4, 2024: Outperforming Ad Peers at Megamort).

Jeffries, Magna Global

Jeffries, Magna Global

This market share growth is driven by Meta’s cutting-edge advertising technology, which should drive advertising effectiveness and customer ROI. In that regard, Meta’s 2023 investments amount to approximately $27 billion in capital expenditures and $36.5 billion in R&D, significantly increasing the company’s technological capabilities, particularly through the development of advanced AI-driven advertising tools (such as Advantage+). It is highly likely that it was strengthened. . As suggested in the comments for Q4 2023:

And of course, We are investing heavily in AI-powered tools And the product. So we expanded his Advantage+ suite to all of our different services and it really helped us automate the ad creation process for different types of advertisers.and We’re getting really strong feedback on all of these different features.Advantage+ Shopping is obviously the first, but there’s also Advantage+ Catalog, Advantage+ Creative, Advantage+ Audiences, and more. So we feel these are all really important parts of continuing to improve our advertising business and continue to improve it going forward.

Engagement across platforms looks strong

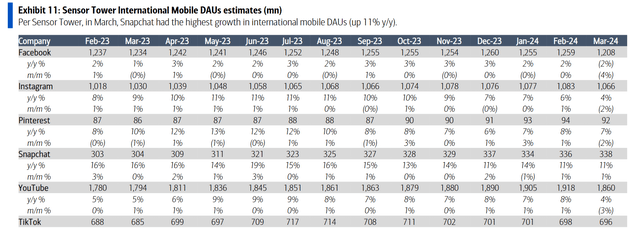

As a social media company, engagement metrics continue to be a key driver for Meta’s stock story. In that context, it’s encouraging to note that download trackers and surveys suggest solid growth and increased engagement in Meta’s social media empire. According to FATA collected by Bank of America, Instagram’s user count likely grew 6% year over year to 1.1 billion DAU, while Facebook’s user count remained flat at 1.25 billion DAU. (Source: His BoFA research note dated April 9: Time spent on social media, users, in March downloads and ARPU benchmarks).

bohua

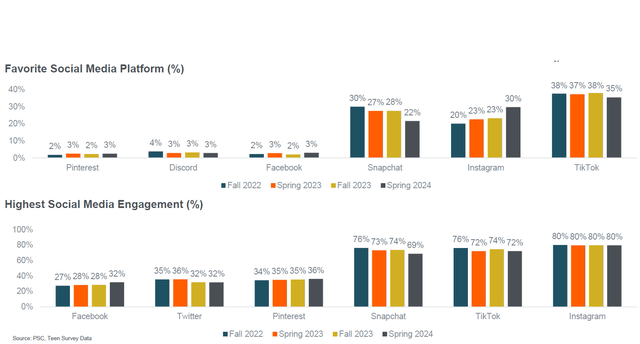

Additionally, we believe Meta continues to see strong user engagement, in large part due to its AI recommendation engine and the introduction of Reels on Instagram. A recent fall study conducted by Piper Sandler Research Team surveyed nearly 6,000 U.S. teens in 47 states about their social media preferences. In that context, on a macro level, it’s encouraging to see that the average daily time spent on social media has increased slightly to around 4.7 hours, up from 4.4 hours a year ago by around 0.3 hours. Within the social media landscape, Instagram has emerged as the second most popular app among teens, with nearly 30% of respondents voting for it, an increase of 700 basis points year over year (vs. TikTok is 35%, but a decrease of 300 basis points). Additionally, Instagram stands out as the most-used app with a monthly usage rate of around 80%, while competitor TikTok remains in second place at 74%, down around 200 basis points from fall 2019. It’s also worth pointing out that. Meanwhile, his competitors’ usage of BeReal continues to decline from their fall 2022 peak (Source: Piper Sandler research note dated April 9: Teen Survey: Instagram’s Big Jump, Snaps to #3 Favorites, PINS/RBLX (+), TT Shop (+)).

piper sandler

Cavenah Research Revenue Forecast

I already noted that I expect Meta to report at the high end of the company’s guidance of $34.5 billion to $37 billion. In my opinion, based on confidence in the strength of the digital advertising market, $36-37 billion should be reasonable compared to the consensus estimate of $36.2 billion. In terms of costs, Meta expects to remain disciplined going forward, likely trending in line with Q4’s approximately $23.5 billion in expenses. Therefore, operating income is expected to be approximately $12.5 to $13.5 billion, which is in line with the consensus of approximately $13.2 billion. Capital distribution to shareholders will be another important metric to watch in the first quarter. However, we do not expect comments on Meta’s distribution policy to be a major driver of stock price, especially after the fourth quarter dividend announcement. Still, it will be important for investors to know how Mark Zuckerberg & Company balances the capital investment needed to develop/deploy GenAI with cash distributions to shareholders. Finally, we expect to see a lot of analyst discussion on Meta’s recently released Llama 3. Llama 3 is what the company calls “the most performant and openly available LLM to date.” Given that this model is open source and free, analysts and investors were eager to learn how Meta plans to leverage his AI capabilities for revenue generation and cost discipline. It will be.

Key points for investors

I’m optimistic about Meta Platforms stock as we approach the company’s Q1 earnings report, as I don’t think the market fully appreciates the strength of advertising momentum and Instagram/Facebook engagement. Additionally, I expect Meta management to talk about the company’s GenAI ambitions and potentially boost investor sentiment through an earnings call with analysts. In terms of valuation, Meta trades at a reasonable 19x (FWD) EV/EBIT, which is comparable to Google (GOOG) and Apple (AAPL) multiples, but probably below fair value for Meta. There is a possibility. In my opinion, an EV/EBIT multiple of around 25x is reasonable, consistent with the valuation level of other large AI players such as Microsoft (28x EV/EBIT) and Nvidia (25x EV/EBIT), and the stock price is expected to exceed $600. . In conclusion, I expect Meta stock to soar on the back of strong earnings. And as a tactical move, he is considering building a position in META stock and taking time-sensitive call options as a short-term options strategy in line with my theory. Investors who want to take advantage of similar expectations may want to consider a call spread with a 105/115% moneyness expiring on May 3rd. These options could yield a 4-to-1 return if Meta’s stock reaches $550 by expiration.