Investors are happy to let Mark Zuckerberg own the Metaverse, but only as long as he keeps pouring in ad dollars. We hope the CEO of the world’s largest social network knows where the Metaverse is.

Investors are happy to let Mark Zuckerberg own the Metaverse, but only as long as he keeps pouring in ad dollars. We hope the CEO of the world’s largest social network knows where the Metaverse is.

Meta Platforms, the parent company of Facebook and Instagram, reported first-quarter results on Wednesday afternoon, becoming the first big-cap tech giant to report results for the same period. It is no exaggeration to say that expectations are high. Meta shares are up 36% since the beginning of the year, even as the tech industry as a whole plunged on Friday. This significantly outperformed all major technology companies, excluding Nvidia, and was the fifth-best performing stock on the S&P 500 at the time.

Hello! You are reading a premium article! Subscribe now to read more.

Subscribe now

Premium benefits

35+ Premium daily articles

specially selected Newsletter every day

access to Print version for ages 15+ daily articles

Subscriber-only webinars by expert journalists

E Articles, Archives, Selection Wall Street Journal and Economist articles

Access to subscriber-only benefits: Infographics I Podcast

Well-researched to unlock 35+

daily premium articles

Access to global insights

100+ exclusive articles from

international publications

Free access

3 or more investment-based apps

trendlin

Get 1 month of GuruQ plan for just Rs.

finology

Get one month of Finology subscription free.

small case

20% off all small cases

Newsletter exclusive to 5+ subscribers

specially selected by experts

Free access to e-paper and

WhatsApp updates

Meta Platforms, the parent company of Facebook and Instagram, reported first-quarter results on Wednesday afternoon, becoming the first big-cap tech giant to report results for the same period. It is no exaggeration to say that expectations are high. Meta shares are up 36% since the beginning of the year, even as the tech industry as a whole plunged on Friday. This significantly outperformed all major technology companies, excluding Nvidia, and was the fifth-best performing stock on the S&P 500 at the time.

Meta’s market capitalization of just over $1.2 trillion is now 13% above its peak in late 2021 and more than five times the level it fell to the following year. The company’s stock currently trades at about 24 times forward earnings, a 5% premium over Google’s parent company Alphabet, according to FactSet data. Meta’s stock had averaged a 13% discount to its biggest rival over the past three years, prior to its last earnings report in February, which sparked the stock’s recent rally.

There are several factors behind the recent rise. Meta’s advertising business bounced back from a slump in 2022, with full-year operating margins improving by 10 percent thanks to deep cost cuts in what Zuckerberg called a “year of efficiency.” The company also used the previous report to ramp up and initiate share buybacks. First ever dividend.

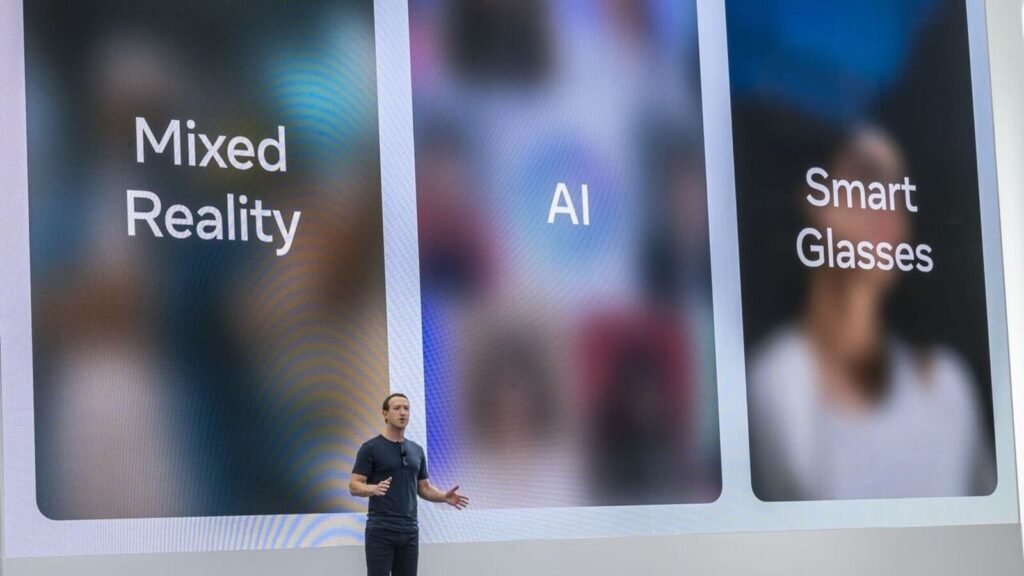

Meta has enjoyed the same artificial intelligence halo that lifts most major technology companies. The company released the latest version of its large language model, called Llama 3, on Thursday. But while Google has been held back a bit by investors worried about its genAI chatbots displacing its core business of internet search, parent company Facebook has an infrastructure of around 3.2 billion people checking The advantage is that you can incorporate AI into your advertising business without worrying. It somehow disappears in everyday life. “The meta moat is likely to continue to grow with new generation AI advertising tools,” Jefferies’ Brent Till wrote earlier this month.

Investors are betting on it. Analysts expect Meta’s first-quarter sales to rise 26% from a year ago to nearly $36.2 billion, which is also at the high end of the company’s own forecast range. Full-year advertising revenue is expected to increase by 17%, one point better than the 16% growth the company achieved last year. Operating margins are also expected to continue rising, reaching 39% this year, compared with 35% in 2023, according to FactSet data.

All are doable. Meta hasn’t missed the midpoint of his company’s revenue outlook for the past six quarters, and total annual costs and expenses have been below his original target range in three of the past four years. In particular, the reel is showing strength. The short-form video service Meta uses to compete with his TikTok had an average ad load of 20% in the first quarter, compared with 16.2% in the same period last year, according to a Citigroup analysis. Even if TikTok is banned in the U.S., Reel could benefit in the long run. The House version of that bill passed over the weekend.

However, the online advertising business can fluctuate unpredictably due to world events such as war, natural disasters, or even Apple’s adjustments to the iOS platform. The latter suppressed advertising growth for Meta and its social network competitors in 2022, making advertising growth difficult. Advertisers track mobile users.

Geopolitical tensions and market shifts could also impact spending from China-based advertisers, which accounted for 10% of Meta’s revenue last year. Bernstein analyst Mark Schmulik said in a report on Thursday that e-commerce startup Tem’s U.S. digital ad spending fell “significantly” from February to March, which the company said was due to “regulatory restrictions.” “In the face of the above uncertainty, they began to focus on other areas.”

Meta also needs to strike the right balance between investing heavily in AI and maintaining its recently restored profit margins. The company is already projecting annual capital spending in the range of $30 billion to $37 billion, which would be the highest spending of any major tech company as a percentage of projected revenue. And AI requires more than servers and his expensive Nvidia chips. Meta told analysts in its last earnings call that it plans to resume hiring in key areas, which will “further shift the workforce toward higher-cost technical positions.” Ta.

Email Dan Gallagher at dan.gallagher@wsj.com.