many microsoft (NASDAQ:MSFT) insiders have unloaded shares in the past year, which may be of interest to the company’s shareholders. When analyzing insider transactions, it is usually more valuable to know whether insiders are buying than to know whether they are selling. Because the latter sends an ambiguous message. However, shareholders should look deeper if multiple insiders have been selling shares over a period of time.

While insider trading is not the most important thing in long-term investing, we think it would be foolish to ignore it completely.

Check out our latest analysis for Microsoft.

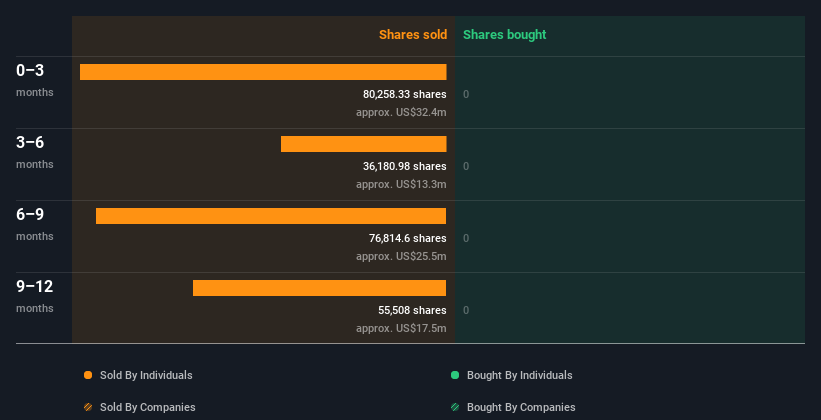

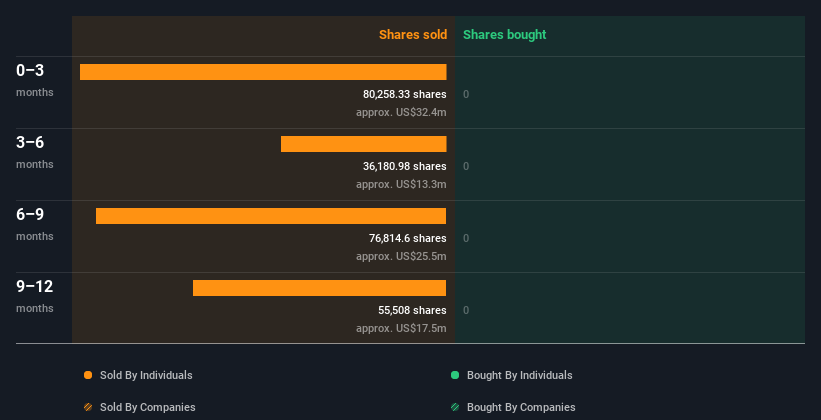

Insider trading at Microsoft over the past 12 months

The biggest sale by an insider in the last twelve months was when the President and Vice Chairman, Bradford Smith, sold US$20m worth of shares at a price of US$412 per share. So we can see that insiders sold shares at around the current share price of $399. Insider sales are negative, but for us it’s even more negative if the stock sells at a lower price. This sale took place at about current prices, so it’s not a big concern, but it doesn’t bode well.

Microsoft insiders didn’t buy any shares in the company last year. You can see a visual representation of the insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, click on the chart below.

I would like Microsoft even more if there was a major insider purchase.While you wait, check this out free A list of growing companies with significant recent insider purchasing.

Microsoft insiders are selling stock

There was significant insider selling in Microsoft stock last quarter. Specifically, insiders offloaded US$33m worth of shares at the time, and the company recorded no purchases at all. With this in mind, it’s hard to say that all insiders think the stock is a bargain.

Does Microsoft boast high insider ownership?

Many investors like to see how much of a company’s shares are owned by insiders. We think it’s a good sign if insiders own a significant number of shares in the company. It’s great to see that Microsoft insiders own 0.03% of the company (worth about US$1 billion). I like to see this level of insider ownership. This is because management is more likely to have the best interests of shareholders in mind.

What can we learn from Microsoft’s insider trading?

Insiders haven’t bought Microsoft stock in the past three months, but there has been some selling. And last year, there were no purchases. On the plus side, Microsoft is profitable and its profits are increasing. While it’s good to see high insider ownership, there is some insider selling which makes us cautious. So while it’s useful to know what insiders are doing in terms of buying and selling, it’s also useful to know the risks facing a particular company.For example, Microsoft 1 warning sign I think you should know.

of course, You may find a great investment if you look elsewhere. So take a look at this free List of interesting companies.

For the purposes of this article, insiders are individuals who report their transactions to the relevant regulatory body. The Company currently only accounts for open market transactions and private dispositions of direct profits, and does not account for derivative transactions or indirect profits.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.