Lionel Bonaventure/AFP via Getty Images

Microsoft investment theory

I think microsoft (NASDAQ:MSFT) are in a very attractive position to take advantage of the AI opportunities that lie ahead. Because Satya Nadella’s foresight has enabled Microsoft to achieve so much. Realize synergies between existing products and what AI can do.

Available on Microsoft 365 and GitHub, CoPilot helps people be more productive by helping them work faster and more efficiently. Plus, you can automate boring and repetitive tasks so your customers can focus on creative tasks. As a result, Azure gained market share in Q2 thanks to the AI benefits of Azure AI and its LLM and SLM access.

And you can see just how important Copilot is to Microsoft by introducing the first Copilot button on the Windows keyboard. The first major keyboard change in 30 years. And to put that in perspective, his Copilot on GitHub significantly contributed to GitHub’s 40% year-over-year revenue growth.

And with impressive showcases of OpenAI, Dall-E, and especially Sora over the past few days, Microsoft has a lot going for it. I also believe that generative AI could disrupt the search market and threaten Google’s dominance. And the fact that his OpenAI with its Transformers technology may be involved in this is noteworthy, as it originally came from Google Research Labs.

MSFT indicators and balance sheet

Microsoft has a fortress-like balance sheet. It has $80 billion in cash and just $44 billion in long-term debt. Its cash position is therefore almost double its long-term debt, and it also generated $82 billion in net income over the past 12 months. In this way, it provides liquidity and protects the downside of the balance sheet.

Additionally, Azure’s growth story continues. The Server Products and Cloud Services segment, which includes Azure, SQS Server, Windows Server, and GitHub, has recorded the following revenue growth rates since the second quarter of 2023:

| Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 |

| twenty two% | twenty two% | twenty one% | twenty four% | twenty four% |

However, on a standalone basis, Azure is actually growing faster than this segment, held back by its server products, which in some cases has experienced negative growth.

| Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 |

| 31% | 27% | 26% | 29% | 30% |

And data center and server revenues are most likely to benefit from current AI trends, perhaps seeing even greater growth from 2024 to 2025. As such, Microsoft is well-positioned to take advantage of growth opportunities.

In addition, there are Dynamics products that include intelligent cloud-based applications. This sector also grew by 22% and 21% in the first two quarters of this financial year. As a result, Microsoft has several fast-growing segments.

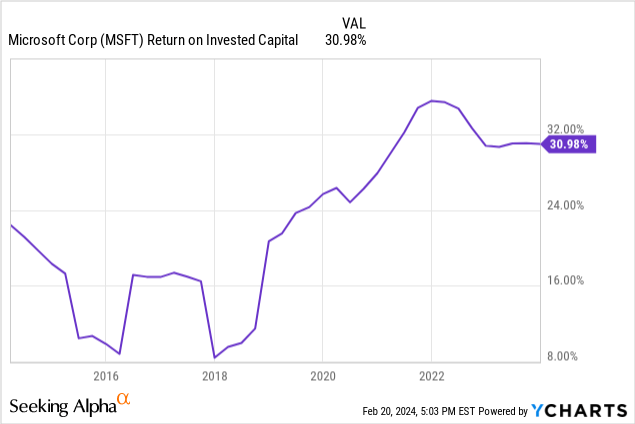

ROIC and capital allocation

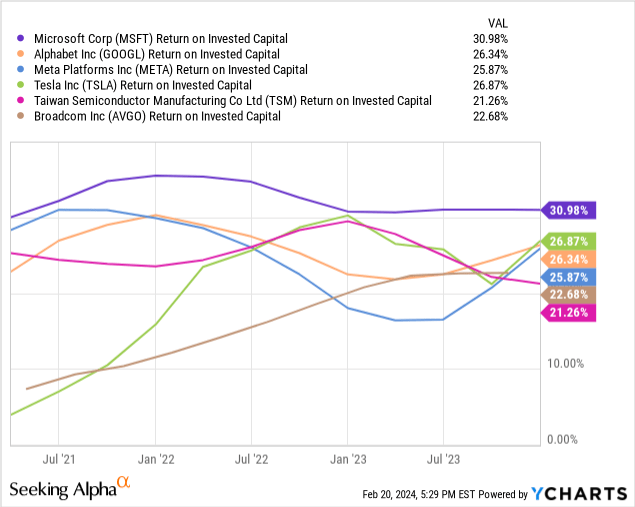

Microsoft’s WACC is around 9%, so the ROIC-WACC spread is very good. Therefore, the spread is 31% – 9% = 22%. Many companies would be satisfied with an ROIC of 22%. This is already a very good value, but Microsoft is simply achieving this value as a spread. This is a testament to the fact that Microsoft is one of the highest quality companies in the world. This is not possible without a significant competitive advantage.

For comparison, let’s look at the ROIC of Google / Alphabet (GOOG), Meta / Facebook (META), Tesla Inc (TSLA), TSMC (TSM), and Broadcom (AVGO). All of these companies are incredibly powerful and world-leading companies. However, the ROIC is about the same as Microsoft’s ROIC-WACC spread.

Microsoft Investor Information

Additionally, Microsoft is a truly shareholder-friendly company. The amount of cash returned to shareholders through share buybacks and dividends increases almost every year.

Over the past 20 years, Microsoft’s dividend CAGR has been around 13%, and its annual dividend growth rate since 2017 has typically been around 10%. MSFT stock’s average annual return from 2004 to 2024 is approximately 14.67%, increasing to 16.96%. With drip, you can see your total return increase by about 2% per year when reinvested due to growing dividends. This is another sign that Microsoft’s dividend policy is working for shareholders.

DRIP Return Calculator Dividend Channel

We also see that Microsoft outperformed the S&P 500 by nearly 4x over 20 years, assuming a $10,000 investment.

Microsoft evaluation with reverse DCF

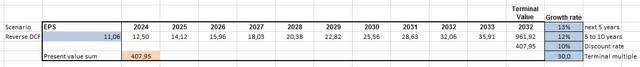

author

I think it’s always important to know what the market is pricing in, and a reverse DCF is probably the best way to find out. And currently, based on TTM diluted EPS of $11.06, the market is pricing in an EPS CAGR of approximately 12%-13% over the next 10 years. The historical EPS growth rates are: 10 years: 15.14%, 5 years: 20.74%, 3 years: 18.14%. All of these numbers are higher than what the market is pricing in.

Therefore, if Microsoft can continue this trend and achieve a CAGR in line with its track record, the stock looks undervalued.

There are plenty of growth opportunities in generative AI and cloud, and share buybacks should also contribute to EPS. So let’s take a look at some guidance to better understand EPS.

What will the EPS be in five years?

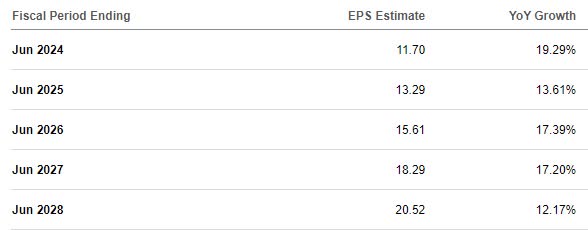

Get an alpha return estimate

Microsoft’s June 2028 earnings forecast is EPS of $20.52, which translates to a stock price of approximately $615 at a 30x multiple. This represents an increase of up to 50% over the period.

However, looking at EPS wins and losses, since June 2015, Microsoft has only missed annual estimates once and exceeded them eight times. Therefore, estimates tend to be conservative, so it’s unlikely that Microsoft will beat EPS estimates in the future.

Now, assuming Microsoft continues to outperform its earnings over the next few years, and outperforms it in four out of five years, an EPS of $23 to $24 is realistic, and the stock price would be between $690 and $720.

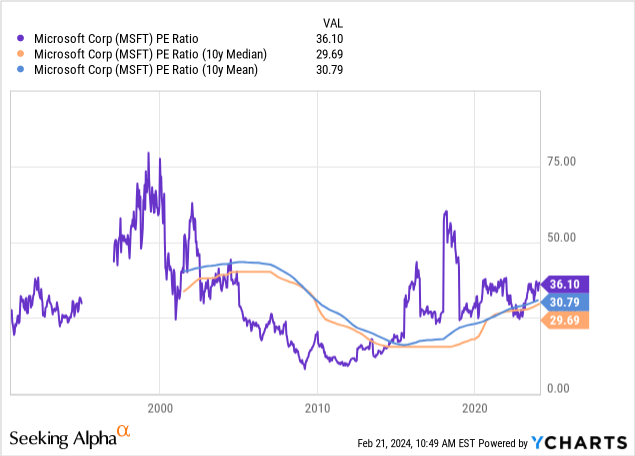

We used a multiple of 30x because this is roughly the 10-year median and average P/E ratio. But with generative AI and all the new opportunities, I wouldn’t be surprised if that multiple moves closer to 35x in his five years. However, to be more conservative, we used a magnification of 30x. That way I have a safety margin.

Microsoft risks

I really think AI will probably change our lives more than smartphones. But the big question will be which companies will benefit the most. And at this point, Microsoft has OpenAI and Sam Altman, so he’s likely to be one of the companies that will benefit greatly. Plus, they also have a kind of first-mover advantage. However, I think this benefit is often overestimated, as we saw with Google and Yahoo. In the end, the best product usually wins.

And just as generative AI threatens to disrupt traditional search engines. As our world becomes even faster-paced, new technologies may pose a threat to generative AI in the future.

Additionally, initial results with Microsoft’s Copilot have been mixed, leaving room for improvement. However, it should be noted that this is only one of the first versions and many more improvements will be made in the future. Meanwhile, many companies have successfully streamlined and optimized their business processes with the help of Microsoft and its AI products.

conclusion

In the near future, Microsoft Copilot will allow you to create your own GPTs using a set of simple prompts to further customize your AI experience. And multimodal search, combined with GPT 4 and Vision, could transform the search experience enough for Microsoft to take even more market share from Google.

Similarly, the deep search feature is designed to improve search results. It is designed to answer complex and highly specific questions that today’s generation of search engines can only partially answer.

Combining this with the AI capabilities of Azure AI and various Office products will ensure Microsoft has significant opportunities for future growth. Being able to create a Word or PowerPoint document from a dataset with a single click has a huge impact on your workflow. And ideally, the data is quickly analyzed and important conclusions are presented.

If Microsoft comes up with a satisfactory solution, it will have a significant impact on many areas and will probably have a very positive impact on Microsoft’s future profits. Therefore, I am confident that Microsoft will be an even stronger company in his five years than it is now.