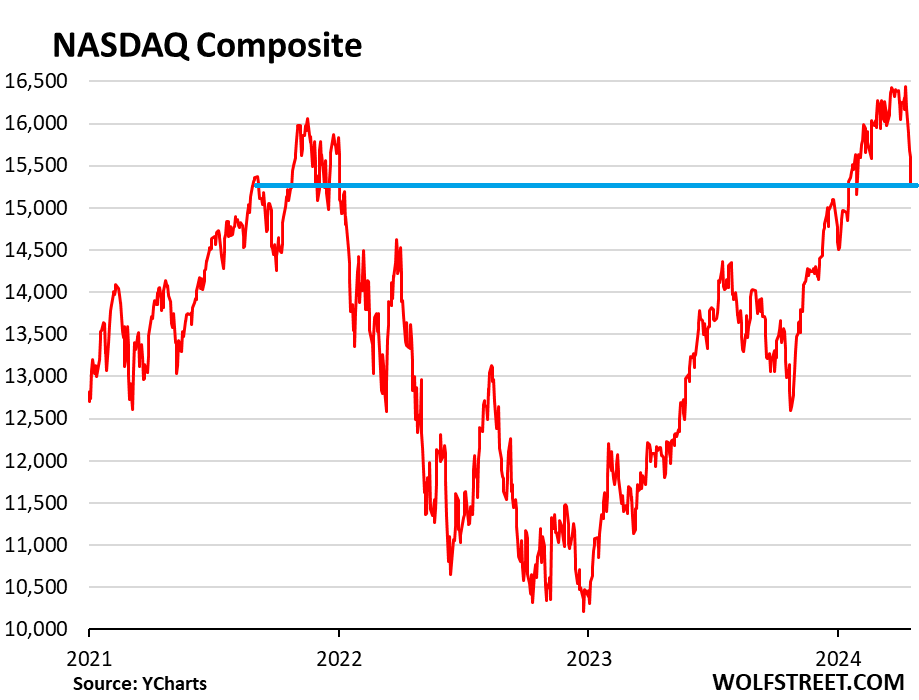

The Nasdaq fell 2.05%, returning to September 2021 levels. Here are some new WTF charts for this year.

Written by Wolf Richter of Wolf Street.

The Nasdaq Composite Index fell 2.05% today to 15,282, returning to its starting level in September 2021. It has fallen 7.6% since its all-time high of 16,538 on March 21st.

Apparently, the show of AI and semiconductor hype and fuss got cut short for some reason, or it just got too ridiculous and people started walking away from it. Some of the big names from that show took the plunge today. We’ll talk about some of them in a moment.

Apparently, this is not a great investment since September 2021. At that time, it became clear that the Fed would stop printing money, retire some of the money it had printed, and then start raising interest rates. Nevertheless, it’s been quite a roller coaster ride (all stock data in the chart below is from YCharts).

Nvidia [NVDA] It plunged 10% today to $762.00, the worst single-day drop since March 2020. It is down 21.8% from its all-time high of $974 on March 25th. It became infamous here on February 24th at this joint. We praised it then. This is this year’s chart. At the time, NVIDIA’s market cap had soared to nearly $2 trillion, and its stock price had reached $788.

We compared it to Tesla, which is an incredible chart this year. Tesla was relegated to the pantheon of distressed stocks a few years later, but business continued to boom, and the Model Y became the best-selling model in the world. . It just meant that mania was starting to ooze out of stock.

The minimum requirement for entry into the pantheon is for stock prices to fall at least 70% from their all-time highs. For NVDA to join the pantheon, the stock would have to fall to $292, which isn’t difficult. It was at that level just 10 months ago. It was already an extremely expensive stock back then. So today we’re celebrating this with our new and improved WTF chart for him this year.

But it gets more interesting. I mean, look, you can’t take this thing seriously.

super microcomputer [SMCI] has been deeply involved among AI enthusiasts as it is one of the many vendors building servers based on Nvidia’s GPUs. Shares fell 23% today to $713.65 after the company skipped the expected preliminary results ahead of its official results. At a stock price like this, anything can trigger a huge uproar. It has fallen 42% from its all-time high of $1,229 on March 8.

In the 12 months leading up to its all-time high, the stock price rose more than 1,100%. This content is just interesting. The children are having a lot of fun. It is currently giving up 40% of its profits. This shows how stupid the market has become.

arm holdings [ARM] It plunged 16.9% today to $87.19. It has fallen 28.7% in the past three business days. The chip designer held an IPO in September 2023. SoftBank owned 90% of the company at the time, and still owns the majority of it. In February, ARM doubled in a few days.

SOX semiconductor index It is down 4.1% today and is down 16.6% from its all-time high on March 8th.

![]()

Not related to AI: Netflix The company announced strong financial results today, but shares plunged 9.0% after including disappointing revenue forecasts. And next year, it announced it would stop reporting the subscriber numbers that everyone has come to rely on. This is another very interesting double WTF graph.

Other giants had more modest declines today.:

- apple [AAPL]: -1.2% today at $165, down 17% from its all-time high.

- meta [META]: Today -4.1%, $481.07

- Amazon [AMZN]: Today -2.6% to $174,63

- alphabet [GOOG]: 1.74% today at $399.12

- microsoft [MSFT]: -1.3% ~ $399.12

- tesla [TSLA]: -1.9% to $147.05, down 64% from the all-time high in November 2021.

Enjoy reading and supporting Wolf Street? You can donate. I appreciate it very much. Click on the beer and iced tea mugs to see how.

Would you like to receive email notifications when new articles are published on WOLFSTREET? Sign up here.

![]()