NEW DELHI: Several courts have now ruled that online gaming is a “game of skill” as opposed to gambling, which is a “game of chance”.

Prime Minister Narendra Modi’s interaction with Indian gamers, including Animesh Agarwal and Mithilesh Pathan, earlier this month was about more than just sports and attracting young voters ahead of the Sabah elections. The conference highlighted the growing importance of the gaming industry and the government’s interest in its development. The online gaming sector has emerged as a powerhouse of innovation, engagement and economic potential, and in recent years, factors such as the proliferation of smartphones, stronger internet connectivity, a rapidly growing youth population and increased awareness have increased the popularity of online gaming. It’s increasing amazingly. Development of local gaming content tailored to individual tastes.

Raghav Anand Partner at Ernst & Young Parthenon said the online gaming sector has historically attracted significant investor interest, with a total of 229 He points out that investments worth 310 million rupees have been made. India continues to be a ‘mobile-first’ market, with 94% of the total gamer base engaged in mobile gaming experiences, and online mobile gaming emerging as his USD 1.5 billion sunrise sector, with a CAGR of 38% and bring that value to the United States. According to a report by Ernst & Young, it will reach $5 billion by 2025.

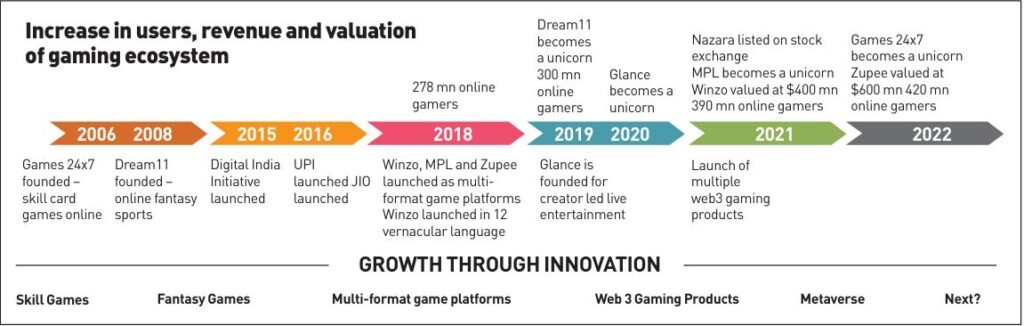

According to the All India Gaming Federation, between 2014 and 2020, the Indian gaming industry collected USD 575 million. However, in the first quarter of 2021 and 2022 alone, USD 1.7 billion was invested in India’s online skill gaming sector. Currently, his three online skill gaming companies have achieved unicorn status. The current industry estimates that over 100,000 direct jobs have been created so far and is expected to create over 500,000 direct and indirect jobs by the sector by 2028.

However, it has achieved an adrenaline-pumping compound annual growth rate (CAGR) of 28% in the last three years, reaching Rs 16,428 crore in FY23. The entire online gaming sector in India is looking for quick solutions to a number of challenges, ranging from an uncertain regulatory environment. , an impasse over the process of setting up a self-regulatory body (SRB) for the online gaming industry, ultra-baile regulations by states, and a 28% GST on amounts “deposited with suppliers” applicable to online gaming and casinos. Despite the rapid growth in gaming consumption, India’s online gaming sector accounts for only 1.1% of global online gaming revenue. A stable regulatory and legal framework is essential for the sector to truly grow. Uncertainty can prevent you from realizing your full potential and hinder your ability to scale quickly.

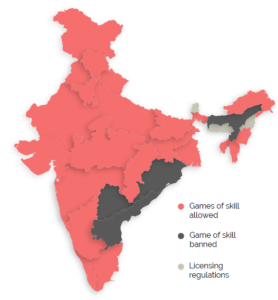

In response to the urgency, the central government announced the Online Gaming Regulations in April 2023, establishing a clear autonomous framework to regulate the skill-based gaming sub-segment. This segment faced many regulatory challenges due to the lack of a unified framework before the rules for online gaming were established. One of the key challenges lies in the hotly contested distinction between “games of skill” and “games of chance.” Games where success depends on an advantage or a significant degree of skill are “games of skill”, whereas games where success depends on an advantage or a significant degree of chance are called “games of chance”. Several courts have now ruled that online gaming is a “game of skill,” as opposed to gambling, which is a “game of chance.” In most online games, a player’s success or loss is determined by their abilities (brains, athleticism, analytical skills), but in gambling there is no correlation at all.

In addition, gamers pay a small fee to an online gaming operator (OGP) to play against each other. However, in gambling, players play against the house, and structurally the operator is also one of the players. However, some states have amended their gambling laws to ban similar games within their states, including games of skill. For example, the Tamil Nadu government tried to ban rummy and poker. However, in November 2023, the Madras High Court lifted the ban, stating that rummy and poker are games of skill.

Uncertainty in the regulatory framework and the potential for regressive regulation by various states could seriously damage the industry and inhibit innovation and investor confidence. In order to adopt a unified approach and advance its commitment to promote online gaming as a catalyst for the ‘Digital India’ initiative and promote a safe, reliable and accountable online gaming ecosystem, the Center will The assignment of matters was notified in December. For information regarding online games, please contact MeitY. On April 6, 2023, MeitY notified the Online Gaming Regulations to provide a responsible and accountable regulatory framework for online gaming intermediaries.

The regulations call for the establishment of a Self-Regulatory Body (SRB), which will be empowered to declare online real-money gaming permitted if it meets the following criteria: The government feels that the SRB mechanism will help curb the growing threat of offshore gambling. Regulate gambling platforms by ensuring that unauthorized games are completely banned, including their advertising.

However, much to the chagrin of the gaming industry, the establishment of the SRB has been delayed as MeitY is in the process of seeking consensus from various ministries and addressing concerns regarding the regulator’s independence. . There’s also MeitY’s proposal to directly manage the approval mechanism for games and the companies that host them.

Then there is the even bigger issue of GST. Extensive deliberations within the GST Council over the past 12-18 months have resulted in changes to his GST levy in the online gaming sector. Amendments to the GST law in August 2023 specify that litigable claims provided by real money gaming (RMG) platforms will be subject to 28% tax on the full face amount of the deposit. it was done. The RMG format allows players to purchase credits with real money and play the game to earn more credits or lose all their current credits. Until October 1, 2023, RMG companies followed the practice of paying his GST of 18% on platform fees, also known as gross gaming revenue (GGR). From a GST perspective, skill-based games were to be taxed on the basis of ‘other online content’ which would be taxed at 18%. Online gaming continued to pay his GST under this classification, similar to the service tax system.

In 2022, the Government Committee of Ministers (GoM) submitted its first report recommending 28% GST on contested application amount (CEA), with representatives from various states giving their initial views. After lengthy deliberations, the GST Council recommended that the recommendations be re-evaluated. GoM’s. At the 50th GST Council meeting in 2023, the government proposed increasing the tax rate on online gaming to 28%. However, as there was no consensus on the valuation base, the Government of India suggested that the GST Council should take a final decision on this. Thereafter, his GST of 28% on amounts deposited with suppliers will come into effect from October 1, 2023 and apply to online games and casinos. As per the gaming industry’s view, the GST department has maintained that the amendment is only a clarification in nature and that tax is always payable on the face value.

Therefore, RMG companies have been served with tax demand notices in the past few years. The ministry has so far issued tax demand notices worth Rs 1 billion to Rs 1.5 billion to more than 40 RMG companies. There are around 400 of his RMG startups in India. Implementation of the GST amendments is likely to impact the free cash flow of both large and small businesses, thereby posing challenges to innovation efforts. Industry players have suggested that the GST amendments are impacting the unit economics of RMG companies, reducing their profitability, thereby impacting investor sentiment. Industry discussions with stakeholders indicate that the unit economics of RMG companies will be disrupted by this amendment, leading to lower earnings before interest, tax, depreciation, and amortization (EBITDA) margins, with subsequent valuation impacts. It was revealed.

According to a report released by the Think Change Forum, the illegal offshore gambling market is estimated at Rs 820,000 crore (US$ 100 billion) and will grow at an alarming rate of 30% per year to Rs 1,801,540 billion by 2026 after the new GST regime. may grow to. The projected growth will result in tax losses amounting to Rs 6,72,205 crore annually by 2026. According to an interview with his CEO of such illegal overseas gambling sites, these illegal platforms consume at least 12 billion US dollars annually. Therefore, 28% of the annual GST on this amount is paid to the Government of India, amounting to approximately USD 2.5 billion.

According to a letter to the Prime Minister’s Office in July 2023 from a consortium of 30 prominent domestic and international startup investors including Tiger Global, Peak XV Partners and Steadview Capital, the proposed amendments could potentially This could lead to write-offs. The Rs 20,000 crore capital invested in this sector is also expected to impact future investments estimated to be at least Rs 32,000 crore over the next 3-4 years, hampering the growth of the Indian gaming sector. There is.

This is significant given that the demand for gamers in India is expected to grow from 390 million in 2021 to 450 million in 2023. Globally, India’s online gaming industry market share is currently smaller compared to the world’s 23% and 25%. US and China respectively. However, with a CAGR of 38% and a mobile gaming share of 86% in the domestic market, India has the potential to become the market leader in ‘mobile gaming’.

Amid the current impasse, industry players’ path forward signals a commitment by online gaming platforms to reinvent their operating models. Both companies are re-evaluating their business strategies for sustainable operations and growth in response to the GST amendments. While some outcomes may include consolidation and slower growth, the sector’s resilience stands ready to redefine opportunities despite challenges.

In the face of increased GST burden, industry players and stakeholders expect industry consolidation, with small businesses absorbing the financial impact of GST while maintaining sufficient funds for marketing and customer acquisition efforts. We expect that the company will liquidate or be acquired.

Regarding consolidation, India needs to point out that large foreign companies are consolidating to create an oligopolistic market, point out the stakeholders in the industry, and find countermeasures. China’s Tencent is the world’s largest gaming company and one of the biggest investors in major foreign game studios, currently developing some of India’s most popular games.

Most recently, Microsoft acquired Activision Blizzard for US$68.7 billion, and Sony acquired Bungie for US$3.6 billion. However, incentives and strategic support in this sector will help Indian companies emerge on the global stage and compete with Chinese and Western companies, especially in the mobile gaming space.