It’s been a sad week Netflix, Inc. (NASDAQ:NFLX) has seen its investment value decline by 11% to $555 in the week since the company announced its Q1 results. Overall, the results appear to be reliable. Revenues of US$9.4 billion were in line with analyst forecasts, but Netflix surprised expectations by delivering a statutory profit of US$5.28 per share, exceeding expectations by 17%. This is an important time for investors, as they can track a company’s performance in the report, see what experts predict for next year, and see if there have been any changes to expectations for the business. With this in mind, we’ve gathered the latest statutory forecasts to find out what analysts are expecting for next year.

Check out our latest analysis for Netflix.

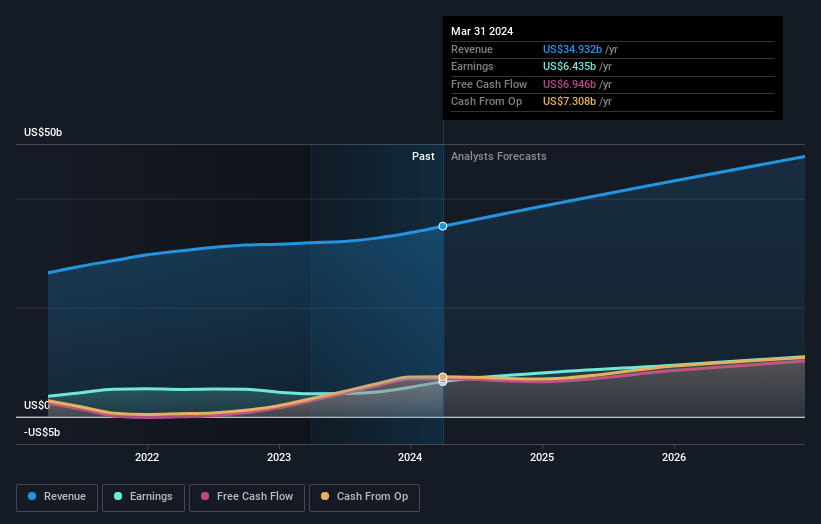

Taking into account the latest results, the consensus forecast from Netflix’s 45 analysts is for revenue of US$38.6b in 2024. This reflects a solid 10% improvement in revenue compared to the previous 12 months. Statutory earnings per share are expected to increase by 21% to US$18.07. However, before the latest results were released, analysts had expected revenue of US$38.6 billion and earnings per share (EPS) of US$17.11 in 2024. As such, the consensus appears to have become a little more optimistic about Netflix’s earnings potential following these results.

There was no significant change to the consensus price target of US$634, suggesting that the improved earnings per share outlook alone is not enough to have a long-term positive impact on the stock’s valuation. The consensus price target is just the average of the individual analyst targets, so it’s useful to see how wide the range of underlying forecasts is. There are mixed views on Netflix, with the most bullish analyst valuing it at $765 per share and the most bearish valuing it at $440 per share. There are certainly some differing views on the stock price, but in our view the range of estimates is not wide enough to suggest that the situation is unpredictable.

One way to get more context about these forecasts is to compare them to past performance and to the performance of other companies in the same industry. Analysts predict that the same will happen in the period to the end of 2024, with sales growth of 14% on an annualized basis. This is consistent with an annual growth rate of 13% over the past five years. In contrast, our data shows that other companies in a similar industry (covered by analysts) are forecast to see their revenue grow at 8.2% per year. So it’s clear that Netflix is projected to grow significantly faster than the industry.

conclusion

The biggest takeaway for us is the improvement in consensus earnings per share, suggesting a clear improvement in sentiment about Netflix’s earnings potential next year. Fortunately, there are no major changes to revenue forecasts, and the business is still expected to grow faster than the broader industry. There was no material change to the consensus price target, suggesting that the intrinsic value of the business has not changed significantly at the latest estimate.

With that in mind, you probably won’t be able to draw any conclusions about Netflix right away. Long-term profitability is far more important than next year’s profits. His predictions for Netflix to 2026 are available for free on this platform.

You can also see our analysis of Netflix’s balance sheet, and whether we think it has too much debt, for free on our platform.

Valuation is complex, but we help make it simple.

Please check it out Netflix Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.