Tom Murton/OJO Images via Getty Images

Previous Roadzen article (Nasdaq:RDZN) Approximately six months ago, I gave this company a “Hold” rating because I highlighted the market opportunity and growth potential it has and believed it was a prudent strategy to take stock and analyze events. At least the first financial results after the acquisition of Vahanna Tech Edge Acquisition Corp. SPAC Unwinding TransactionBefore considering upgrading the rating,

With an innovative product portfolio and strategic acquisitions, Roadzen is worth keeping an eye on. I have not yet taken a position, but I have RDZN on my watchlist. It will be important to monitor financial performance in upcoming quarters, especially improvement in operating margins, before making a decision on this stock.

Excerpts from the previous interview

Roadzen is an InsurTech company focused on providing next-generation auto insurance solutions. Roadzen integrates AI and data analytics into auto insurance and vehicle safety services. It is a platform that enables insurance companies, automotive companies and vehicle owners to easily launch new insurance-related products and services. Roadzen’s technology addresses important real-world challenges and is perfectly aligned with the growing impact of IoT in the automotive industry. The importance of real-time improvements to insurance services, including the underwriting process, cannot be overemphasized, and AI is perfectly suited for this task.

Roadzen has developed over 150 AI models aimed at improving insurtech. Models include computer vision, natural language processing, predictive analytics, and telematics. These models are designed to improve aspects of insurance such as reducing claims time from weeks to minutes and AI-assisted underwriting (dynamic, real-time underwriting based on user driving behavior).

Roadzen’s AI-powered products include xClaim, which streamlines the claims process by allowing policyholders to self-investigate accidents through multimedia, then uses AI and telematics data to analyze, assess damages and repair costs, and provide quotes within seconds.

Mantis – Integrates smartphone, connected car, and visual telematics into a single platform for both Internal Combustion Engine Vehicles (ICE) and Electric Vehicles (EV). It provides end-to-end driver risk assessment and fleet management solutions tailored for Usage-Based Insurance (UBI) and Behavior-Based Insurance (BBI). One of Mantis’ selling points is that it enables fleet managers to optimize total operating costs through telematics-enabled predictive maintenance and real-time alerts. The Mantis telematics platform also supports older ICE vehicles, making it backwards compatible and broadening the product’s reach.

VIA – AI-powered vehicle inspection tool that quickly assesses vehicles remotely for faster claims resolution. VIA uses built-in computer vision and AI models trained on millions of underwriting data to accurately recognize damage and create dynamic reports for underwriting. Roadzen offers this product as a white label to insurance companies and fleet managers, allowing easy integration into existing insurance infrastructure.

Roadzen’s other products include SurePrice, a platform that provides end-to-end portfolio management to insurers, and StrandD, a RoadsideAssistancee (RSA) platform with an online network of RSAs spanning the globe to help insurers manage RSA requests and track their progress in real time. Roadzen’s platform can be easily integrated via APIs and customized to suit clients’ specific needs.

Embedded insurance means abstracting insurance capabilities into technology to enable third-party product and service providers and developers from any sector to seamlessly integrate innovative insurance solutions into their customer propositions and experiences, either as complementary add-ons to core products or as new native components.

Simon Torrance, Founder, AI Risk

Roadzen operates embedded distribution and B2B2C distribution business models. Operating both business models gives Roadzen the advantage of wider market coverage and expansion, and reach to more target customers. This also helps in diversifying the company’s revenue streams. Embedded insurance is touted as an efficient way to distribute insurance services and as a business model transformation for the insurance industry. According to a report by Mordor Intelligence, the embedded insurance market size, in terms of total premium amount, is expected to grow from $156.06 billion in 2024 to $703.44 billion by 2029, growing at a CAGR of 35.14% during the forecast period.

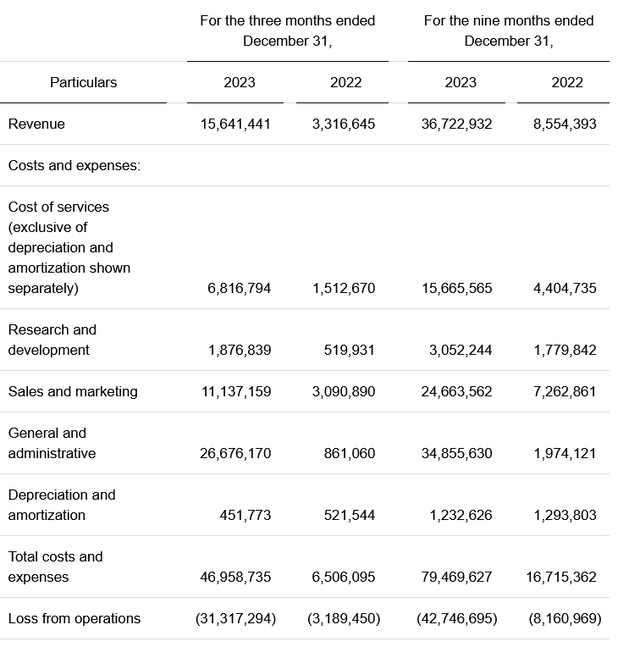

Third Quarter Income Statement (Lordzen)

Roadzen’s latest quarterly (MRQ) report (FY24 Q3) saw revenues grow 372% to $15.64 million. The revenue mix was also balanced with 52% from brokerage sales and 48% from its Insurance as a Service (IaaS) platform. The company recorded a net loss of $30.57 million. Adjusted EBITDA was a loss of $3.1 million, a 14% improvement over the second quarter’s Adjusted EBITDA loss.

The company has the potential to generate recurring revenue streams through its IaaS and brokerage services. For every policy sold through Roadzen’s platform, the company receives commission and policy administration fees. Revenues could grow.

At the moment, liabilities exceed assets, with a current ratio of about 0.8. The company’s cash flow burned has increased by about 109% year over year. Gross margins are currently at 55.6%, but Roadzen needs to seriously reduce OpEx to reach an operating breakeven point. The company currently has high operating expenses and high cash burn in Q3. Looking at the company’s income statement, OpEx in Q3 exceeded sales. This opens up the possibility of debt or equity financing. Roadzen recently filed a prospectus with the SEC for the sale of common stock.

In the third quarter financial report press release, management stated that the company’s net loss was impacted by non-recurring and non-recurring items. These items were not specifically stated in the press release, but typically range from impairments to one-time regulatory compliance charges, technology upgrade charges, and in some cases, one-time research and development charges. We expect these one-time and non-recurring charges to decrease in the next quarter, leading to a healthier income statement for Roadzen, a balanced operating income and ultimately improved profitability.

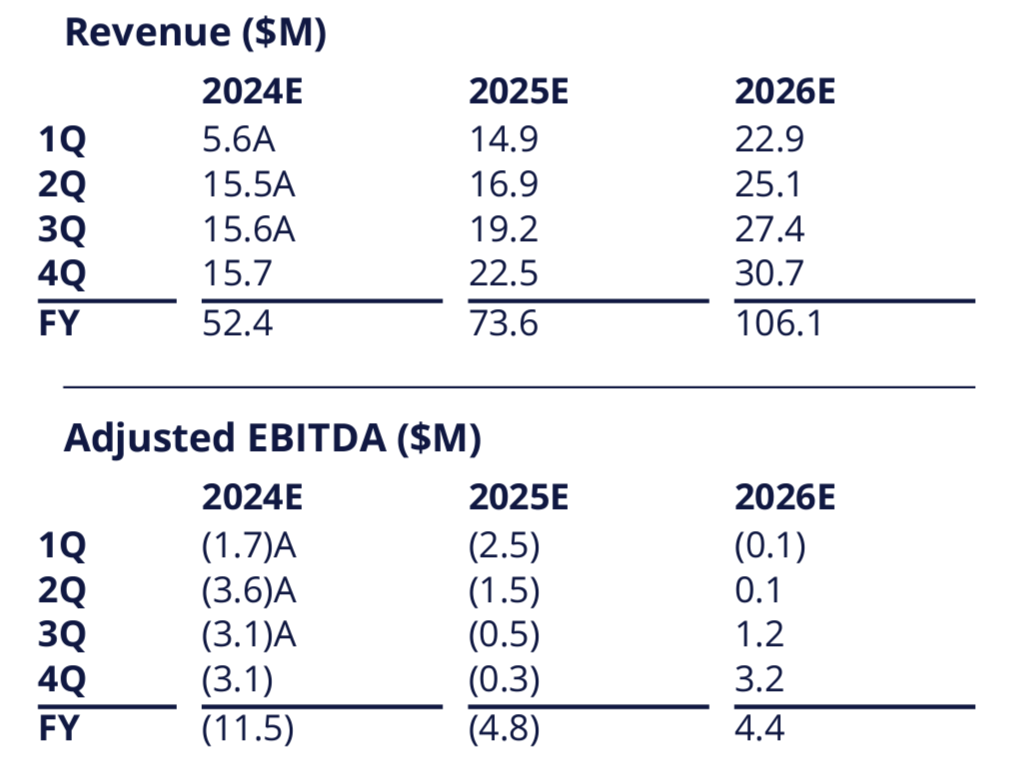

Revenue and EBITDA forecast (Maxim Group)

Maxim Group recently initiated an intrinsic rating on Roadzen based on a discounted cash flow analysis, setting a buy rating and a 12-month target price of $10. Projected revenues for fiscal year 2024 are $52.4 million. Revenues are expected to grow approximately 40% by fiscal years 2025 and 2026, with projected sales of $73.6 million and $106.1 million, respectively. Calendar year 2025 (CY25) sales are expected to reach $97.9 million. The company is expected to achieve positive adjusted EBITDA by fiscal year 2026. Maxim assumed a terminal growth rate of 3% and a discount rate of 18%. We believe both rates are reasonable, but we believe the terminal growth rate of 3% is sufficiently conservative and the discount rate of 18% is sufficiently reasonable, given the risks associated with the business. Regulatory hurdles as compliance and user data protection laws vary across jurisdictions, as well as risks related to AI regulations (already enacted by governments around the world), could pose some challenges to Roadzen’s rapid expansion.Maxim’s $10 target price equates to 7.0x EV/Sales based on FY25 expected revenue and 9.3x EV/Sales based on FY25 expected revenue of $73.6M.

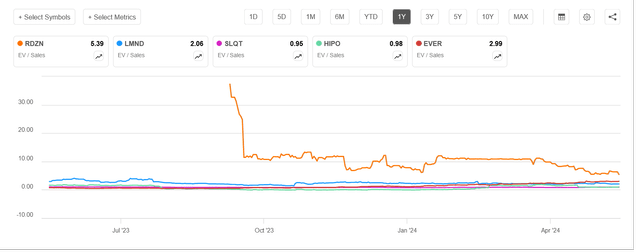

Comparison of EV/Sales between Roadzen and its competitors (Seeking Alpha)

At such multiples, RDZN’s valuation may seem overstated. Relative valuation to its closest competitors such as Lemonade (LMND), SelectQuote (SLQT), EverQuote (EVER), and Hippo Holdings (HIPO) show that RDZN trades at higher EV multiples. However, Rodzen can be categorized as an emerging growth company (EGC) with the potential to capture large insurtech market value using its AI technology stack. With over 150 AI models already in its arsenal, Rodzen puts its money where its mouth is. Its embedded delivery and B2B2C delivery business model are also competitive advantages.

The business has a good customer retention rate; in its latest report, it had 92 enterprise clients and 3,200 SME clients. As a business with a data-driven product, the more clients Roadzen has on its platform, the more data they have available to train their AI models, and these models get better based on in-house and third-party data. Thus, Roadzen’s product gets better and better.