z1b

It can be beneficial to be contrarian when the chips in a particular stock or sector are falling. Although some investors may be tempted to overthink it, value investors may be better off investing in high-quality companies when stock prices are down. Favorable to the market.

In the words of Buffett, in the short term the market is a voting machine, but in the long term it is a weighing machine. This allows the Equity LifeStyle property (New York Stock Exchange:ELS), which I last covered last July, pointing out its quality location and strong balance sheet, but whose valuation seemed a little high.

Since then, ELS has increased its profits and its stock price has fallen 7%. This is primarily due to market concerns about a prolonged interest rate environment. Both of these factors are helping to lower his P/FFO rating for the company.as As you can see below, ELS stock is currently at a 52-week low.

ELS stock (Presentation for investors)

In this article, we review ELS, including the basics of how it operates, and explain why now is a better time to buy this blue-chip stock. So let’s get started!

Why ELS?

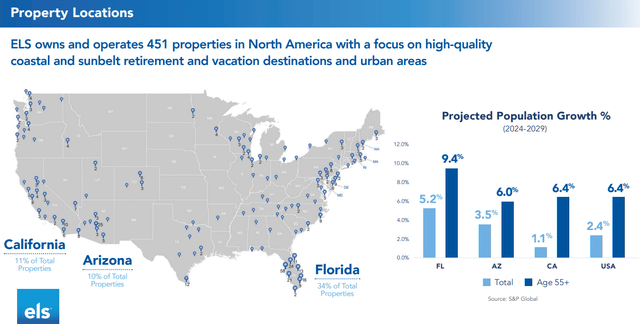

Equity Lifestyle Properties is one of North America’s largest manufactured housing REITs, with 451 properties in 35 U.S. states and one Canadian province. It was founded in 1969 by Sam Zell, who passed away last year, and is a member of the S&P Midcap 400.

Like its peer group Sun Communities (SUI), ELS also owns recreational vehicle (RV) resorts, campgrounds, and marinas in desirable locations throughout North America. As shown below, ELS facilities are located in densely populated areas with above-average population growth rates for people 55 and older, particularly in the warmer states of Florida, Arizona, and California.

Investor presentation

Housing REITs are well known for their economic resilience and responsiveness to inflation. This is reflected in ELS’ strong end to 2023, during which Core MH’s underlying rental income increased by 6.8% year-on-year. Additionally, ELS has made meaningful progress toward addressing the U.S. housing shortage by adding 994 expansion locations and selling 905 new homes last year.

Additionally, total core income from real estate operations increased by 5.2% year-over-year in the fourth quarter of 2023. This is not far off from his 5.7% year-over-year increase in Q1 2023, the last time I visited the stock. This resulted in his NFFO per share in the fourth quarter growing at a solid 11% year-over-year from $0.64 a year ago to $0.71.

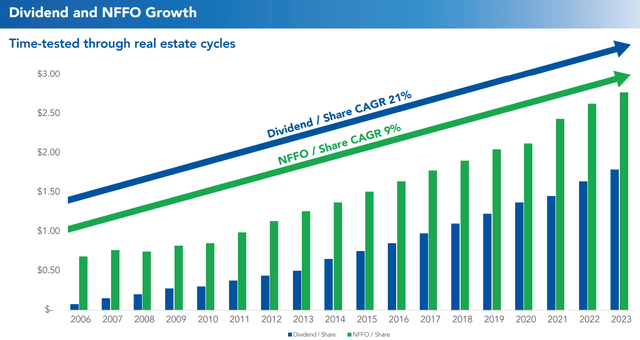

This enabled ELS to continue its strong track record of profit growth. As shown below, ELS has a 9% NFFO CAGR per share and a 21% dividend CAGR per share over the past 18 years (11% dividend CAGR over the past 10 years) .

Investor presentation

Looking ahead, ELS is well-positioned to capture favorable demand trends on the back of a 13% market rental increase in 2023. This is reflected in his 2024 guidance for ELS, in which he expects NOI to increase by 5.6% and NFFO per share to increase by 4.7% in each company. midpoint of the range. Management is also committed to pursuing external growth opportunities in the strategic Sunbelt markets of Florida, California, Arizona and Texas, which account for two-thirds of ELS’ new real estate acquisitions and developments over the past five years. This area occupies the largest share of Japan’s population.

We believe this focus is a good move given that we are building ELS for anticipated future demands from the current working generation. This is supported by management’s comments on the previous conference call regarding the expected growth in the senior population over the next 20 years.

I would also like to point out that subsequent generational cohorts, Gen X, Millennials, and Gen Z, will also follow similar aging trends as the baby boomers. Note that the millennial generation, which will begin to retire in 20 years, has a population of 74 million people, 5 million more than the baby boomer generation.

Overall, the U.S. population aged 55 and older is projected to grow by 6.4% over the next five years. Meanwhile, our Sunbelt properties in Florida, California, Arizona and Texas are projected to grow by 8.5%, outpacing the national growth rate by 200 basis points.

The leader of the Sunbelt states is Florida, the largest state with a strong 9.4% population growth rate for people 55 and older over the next five years, about 300 basis points above the national average. The second largest state is California, with a population of 55 people, which is projected to grow by 6.4% over the next five years, just like the rest of the country.

Additionally, the nationwide housing shortage is expected to be a growth driver for the manufactured housing segment, with the MH market size expected to grow at a CAGR of 6.5% from now until 2027. Additionally, MH remains fairly affordable compared to apartments and houses. family unit. This is especially true in California, one of ELS’s major markets, where housing supply has lagged behind job growth. By some estimates, California will need to build 180,000 units a year by 2025 to meet demand, which aligns fairly well with ELS’ external growth plans.

Meanwhile, ELS maintains a strong balance sheet as reflected in its net debt-to-EBITDA ratio of 5.3x, below the 6.0x level that rating agencies generally consider safe for REITs. . He also has a high interest coverage ratio of 5.2x and available capacity on a revolving credit facility of $435 million.

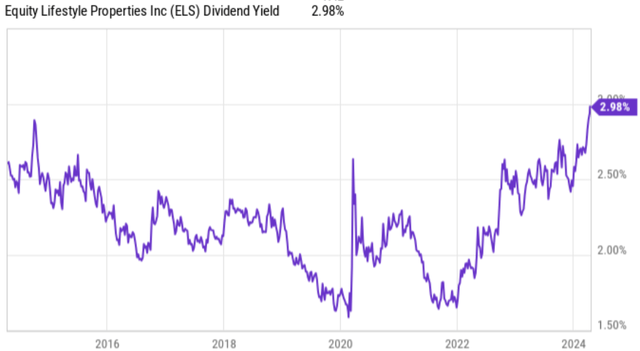

This supports a safe 66% payout ratio and a dividend with a five-year CAGR of 10%. This year, management raised the dividend by 6.7%. Currently, ELS’s yield is 3.1%, the highest it’s been in at least a decade, as shown below.

(Note: The chart below shows the TTM yield. The forward yield is 3.1%)

Y chart

Risks to ELS include the potential for interest rates to rise over time. This increases the cost of maturing debt and also increases the cost of capital for acquiring and developing new real estate. Other risks include macroeconomic factors such as inflation, which could put pressure on households’ ability to absorb rent increases, and a slowdown in travel, which could negatively impact ELS’ RV business.

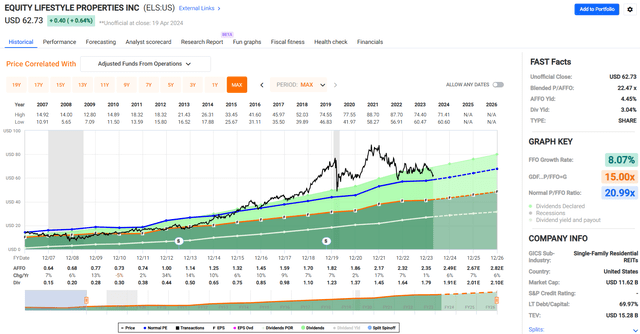

Looking at valuation, ELS’ current price is $62.73 and forward P/FFO of 21.7, which is lower than the P/FFO of 23.3 the last time I visited the stock. This is close to the typical historical valuation of 21.2 P/FFO over the past 20 years, as shown below.

fast graph

ELS isn’t cheap when trading at its historical valuation, but given its accelerated growth over the past decade, I think it deserves a buy rating, which will drive its valuation higher. Analysts forecast annual growth of 6% per FFO/share over the 2025-2026 period, a reasonable estimate given recent demand trends and expansion opportunities across the Sunbelt region. I believe that it is.

When compared to its peers, ELS is more expensive than Sun Communities, with Sun Communities’ P/FFO of 16.5 and UMH Properties (UMH)’s P/FFO of 16.0. However, ELS has a stronger balance sheet (lower leverage ratio) compared to its peers, better geographic diversification compared to UMH, and better exposure to high-demand markets, resulting in higher I think it’s worth the multiplier.

With a dividend yield of 3% and a dividend yield of 6%, ELS can generate a total annual return of 9%. This is very similar to the long-term returns of the S&P 500, but with the advantage of an easy-to-understand business with much higher dividends. yield. As such, we think ELS could be a reasonable buy until P/FFO is 22.

Key points for investors

ELS is well-positioned to benefit from the growing demand for affordable housing among America’s aging population. ELS has demonstrated resilience and consistency in its operating results with a strong track record of revenue growth and a focus on strategic Sunbelt markets.

Although there are risks to consider, such as interest rates and macroeconomic factors, ELS’s strong balance sheet and track record of increasing dividends make it an attractive investment opportunity for those seeking long-term stability. Finally, I think the stock is attractive enough to upgrade from a “hold” to a “buy” rating, given the significant decline in stock price and valuation since I last visited the stock. I feel it.