Investors are looking forward to reports from a wide range of companies across a variety of sectors as markets gear up for another eventful earnings week. Famous companies like Tesla (NASDAQ:TSLA), Microsoft (NASDAQ:MSFT), alphabet (NASDAQ:GOOG) (NASDAQ:Google) and metaplatform (Nasdaq:Meta) is tobacco giant Philip Morris International (afternoon) and Altria Group (M.O.).

The coming week will be filled with earnings for technology and communications giants like IBM (IBM), AT&T (T), Intel (INTC), and Texas Instruments (TXN). AbbVie (ABBV), Merck & Company (MRK), Bristol-Myers Squibb Company (BMY), Gilead Sciences (GILD), AstraZeneca (AZN), AbbVie (ABBV), Thermo Fisher Scientific (TMO), etc. Healthcare companies report as well.

Furthermore, the energy sector will also be in the spotlight, with companies such as Exxon Mobil (XOM), Chevron (CVX), Valero Energy (VLO), and Phillips 66 (PSX) announcing their financial results.

Companies in the industrial sector, such as General Electric (GE), Boeing (BA), Caterpillar (CAT), and Union Pacific (UNP), also announce their financial results, giving an insight into the state of the industrial economy.

In addition, the consumer goods sector includes companies such as PepsiCo (PEP), Kimberly-Clark (KMB), Colgate-Palmolive (CL), Ford (F), and General Motors (GM), which are responsible for consumer spending and its trends. You can get a glimpse of it. request.

The aviation sector will also be in the spotlight, with companies such as American Airlines Group (AAL), Southwest Airlines (LUV) and JetBlue (JBLU) reporting earnings, providing insight into the travel industry’s performance. Parcel delivery giant United Parcel Service (UPS) is also under investigation, and its advantage as a key logistics provider can provide important economic insights.

Below is a summary of major quarterly updates scheduled for the week of April 22-26.

Monday, April 22nd

Cleveland Cliffs (CLF)

The Cleveland Cliffs (CLF) is scheduled to release its first quarter results after the market closes on Monday. Analysts expect the company to be profitable this quarter, while sales will be roughly flat.

The stock has a Hold rating from Seeking Alpha’s Quant Rating System, consistent with the consensus recommendation of Wall Street analysts.

According to a recent article by Seeking Alpha contributor Joseph Parrish, the Cleveland Cliffs are considered an undervalued investment opportunity due to their pricing power and ability to generate positive free cash flow. Parrish expressed a bullish outlook for the company, suggesting it will survive regardless of market conditions.

- Consensus EPS estimate: $0.21

- Consensus revenue forecast: $5.34 billion

- Earnings Insight: The company has exceeded EPS estimates in four of the past eight quarters, with revenue beating estimates in five of those quarters.

It also reports: Verizon Communications (VZ), AGNC Investment (AGNC), Nucor Corporation (NUE), SAP SE (SAP), Alexandria Real Estate Equities (ARE), Albertsons Companies (ACI) and others.

Tuesday, April 23rd

Tesla (TSLA)

Elon Musk’s electric vehicle giant Tesla (TSLA) is scheduled to release its first-quarter results after the closing bell on Tuesday, and analysts expect EPS to decline sharply from a year ago. This is mainly expected due to the impact of price competition.

Tesla, which once boasted a market capitalization of more than $1 trillion, is now the worst performing company in the prestigious Magnificent Seven group of technology and growth stocks. Since the beginning of the year, Tesla’s stock price has fallen by 40%, resulting in its market capitalization falling below $500 billion.

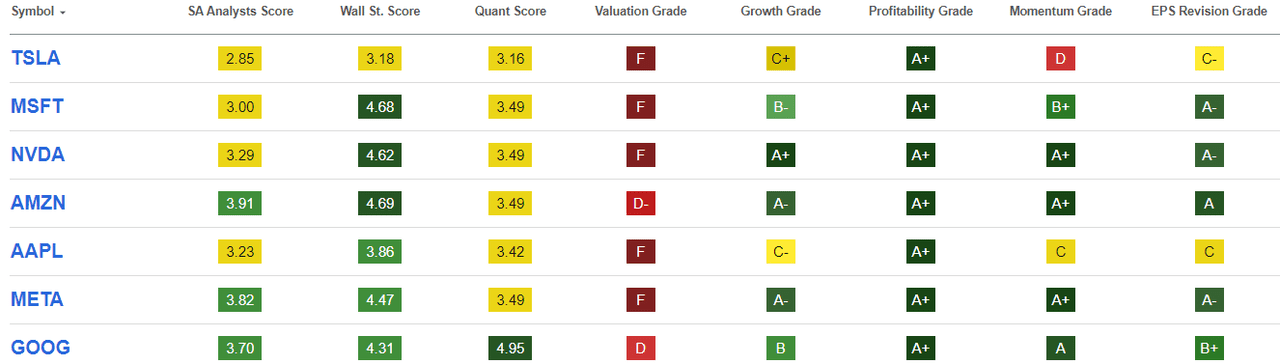

Both the Seeking Alpha Quant Rating System and sell-side analysts have a cautious stance on the stock, assigning it a Hold rating.

Recently, Deutsche Bank downgraded Tesla’s rating to “hold” due to the likely delay of the Model 2 launch and the company’s shift in strategic priorities to its robotaxi business. Analyst Emanuel Rozner said delays in Model 2 efforts could mean no new cars in Tesla’s consumer lineup for some time, putting downward pressure on sales volumes and prices for years to come. We warn that this may occur. Deutsche Bank also lowered Tesla’s price target from $189 to $123, and lowered its forecasts for deliveries, sales, and EPS.

SA author Christopher Robb said: “The company has missed delivery dates for the first time in four years. This indicates the potential for price reductions to be exhausted and it will take time to fully assess the impact of recent job cuts. Probably.”

- Consensus EPS estimate: $0.50

- Consensus revenue forecast: $22.52 billion

- Earnings Insight: Tesla beat EPS estimates in five of the past eight quarters, but its revenue only tripled in that period.

It also reports: General Electric (GE), Visa (V), General Motors Company (GM), Lockheed Martin (LMT), PepsiCo (PEP), Freeport-McMoRan (FCX), Philip Morris International (PM), United Parcel Service (UPS), Texas Instruments (TXN), Halliburton Company (HAL), Spotify Technology SA (SPOT), Kimberly-Clark (KMB), JetBlue Airways (JBLU), Xerox (XRX) ), Pulte Group (PHM), Boston Beer Company (SAM), Rider System (R), etc.

Wednesday, April 24th

Metaplatform (META)

Facebook’s parent company Meta Platforms (META) is scheduled to report its first quarter results after the closing bell on Wednesday. Following impressive fourth-quarter results, including the start of a dividend, the social media giant predicted first-quarter revenue to be in the range of $34.5 billion to $37 billion.

The stock has performed well, rising 42% since the beginning of the year and more than doubling in the past 12 months. The SA Quant Rating System suggests the stock as a Hold, while Wall Street analysts maintain a bullish Buy recommendation.

Trust Securities expects META (META) to beat first-quarter earnings estimates. The company raised its revenue estimate to $36.54 billion from $36.12 billion and its EPS estimate from $4.18 to $4.28. Trust continues to maintain its bullish stance, rating the company’s stock as “buy” and raising its price target from $525 to $550, and Meta’s AI investment is expected to increase user engagement (Facebook usage rate increased 3% year-on-year). ) and that it contributed to improving advertising performance.

SA author Dair Sansyzbayev points out that META excels in revenue growth and cost discipline, and its alignment with the digital revolution gives it a competitive edge. The Llama 3 language model is still under development and our valuation analysis shows that the stock is attractively priced and the current share price is a bargain.

- Consensus EPS estimate: $4.34

- Consensus revenue forecast: $36.16 billion

- Earnings Insight: Meta has exceeded EPS estimates in five of the past eight quarters, with six of those reported quarters beating revenue estimates.

It also reports: AT&T (T), Ford (F), The Boeing Company (BA), IBM (IBM), QuantumScape Corporation (QS), Lam Research Corporation (LRCX), ServiceNow (NOW), Biogen (BIIB), Chipotle Mexican Grill ( CMG)), Hilton Worldwide Holdings (HLT), CME Group (CME), Hasbro (HAS), Humana (HUM), etc.

Thursday, April 25th

Alphabet (GOOG) (GOOGL)

Alphabet (GOOG) (GOOGL) is scheduled to release first-quarter results after the closing bell on Thursday. Analysts expect a strong quarter, with profits up 28% and sales up 13%.

Google’s parent company has had an exceptional performance over the past year, with its share price growing more than 50% over the past 12 months, outpacing the S&P 500’s return of about 21%.

Google has an SA Quant score of 4.95 (out of 5), indicating a “Strong Buy” rating, according to SA Quant Ratings. Wall Street analysts also maintain a bullish stance on the stock, with a consensus rating of “buy.”

However, Dair Sansyzbayev, author of Seeking Alpha, pointed to valuation concerns and said, “Lagging in the AI race is a major threat to Google’s prospects in the cloud business. “We have a bearish view as follows,” suggesting caution. He cites ChatGPT as a potential threat to Google Search’s ad-based model.

- Consensus EPS estimate: $1.50

- Consensus revenue forecast: $78.68 billion

- Earnings Insight: Google has exceeded EPS estimates in four of the past eight quarters, with five of those reported quarters beating revenue estimates.

Microsoft (MSFT)

Microsoft (MSFT) follows Alphabet in the earnings lineup and is scheduled to release its quarterly earnings report after the market closes on Thursday. Analysts expect growth of more than 15% in both sales and bottom line.

Seeking Alpha’s quantitative rating system remains cautious on the stock with a Hold outlook, while Wall Street analysts are bullish and maintain a consensus Strong Buy recommendation.

Citi analysts recently predicted that Microsoft’s artificial intelligence revenue would exceed expectations.

SA author Stuart Allsopp has a very bearish view on Microsoft, citing valuation concerns. Allsop believes investors are relying on unrealistically high growth rates and low required returns for decades to come to justify current stock values.

- Consensus EPS estimate: $2.84

- Consensus revenue forecast: $60.85 billion

- Earnings Insight: Microsoft has beat EPS estimates in seven of the past eight quarters, with revenue beating estimates in six of those quarters.

It also reports: Intel (INTC), Altria Group (MO), Gilead Sciences (GILD), Merck & Co. (MRK), Bristol-Myers Squibb Company (BMY), Caterpillar (CAT), Roku (ROKU), Teladoc Health (TDOC), American Airlines Group (AAL), Snap (SNAP), Southwest Airlines (LUV), Newmont Corporation (NEM), Comcast Corporation (CMCSA), Valero Energy (VLO), AstraZeneca PLC (AZN), Union Pacific (UNP) ), Royal Caribbean Cruises (RCL), Northrop Grumman (NOC), Deutsche Bank (DB), Capital One (COF), etc.

Friday, April 26th

Oil giants Chevron (CVX) and Exxon Mobil (XOM) are preparing to report first-quarter results before markets open on Friday. Seeking Alpha’s quantitative rating system has a cautious stance on the stock, with both ratings at Hold. In contrast, Wall Street analysts remain optimistic, giving both stocks buy ratings.

Amid the current market scenario, analysts expect both CVX and XOM to see year-over-year declines in earnings per share and revenue.

According to bullish SA author Asian Investor, XOM’s low valuation and potential for higher capital returns make it an attractive investment pending the first quarter report. .

Asian investors expect Chevron to report strong earnings due to higher oil prices and OPEC+ supply cuts. They also highlight that the company expects to significantly increase its cash flow and has a track record of returning cash to shareholders through share buybacks and dividends.