This article covers DCF analysis of Microsoft Corp (NASDAQ:MSFT). This is a reliable, data-driven approach to estimating intrinsic value. Instead of using future free cash flow as in traditional DCF models, the GuruFocus DCF Calculator is based on research showing that stock prices have historically been more correlated with earnings than free cash flow. and use EPS without NRI as the default for the DCF model.

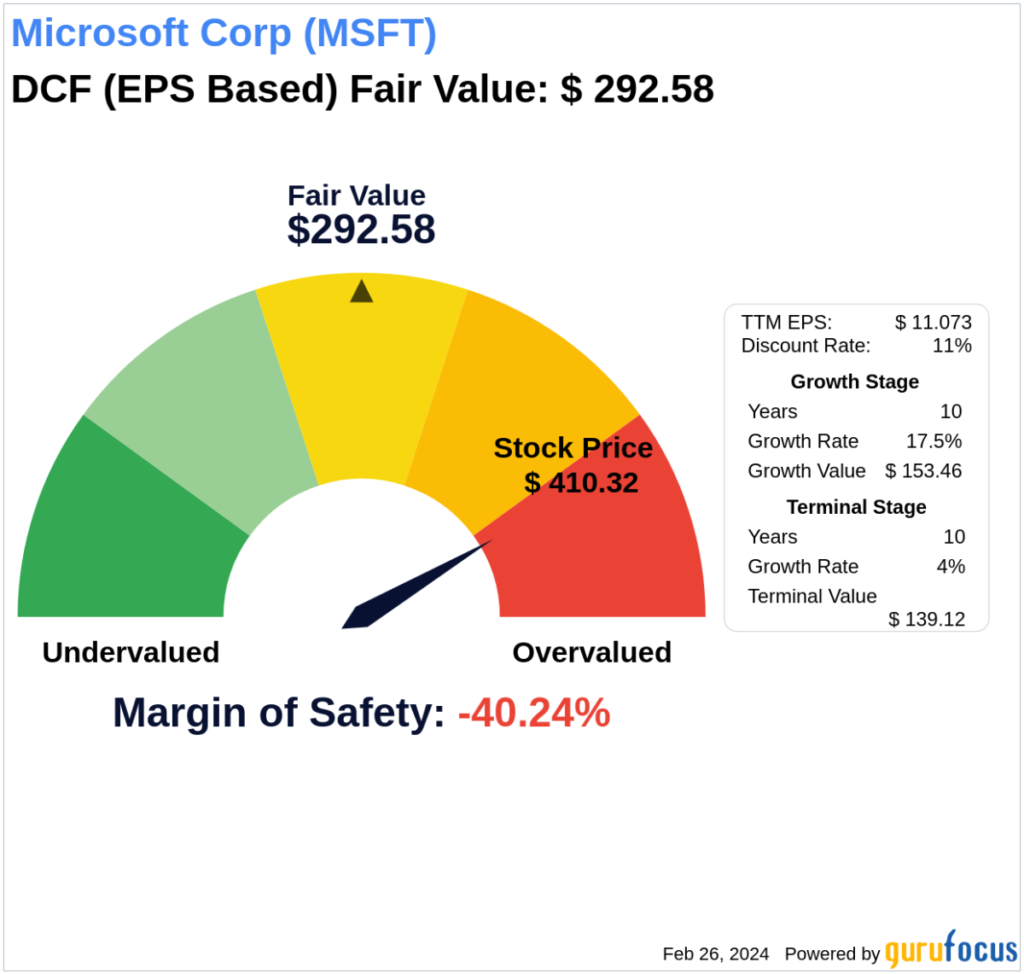

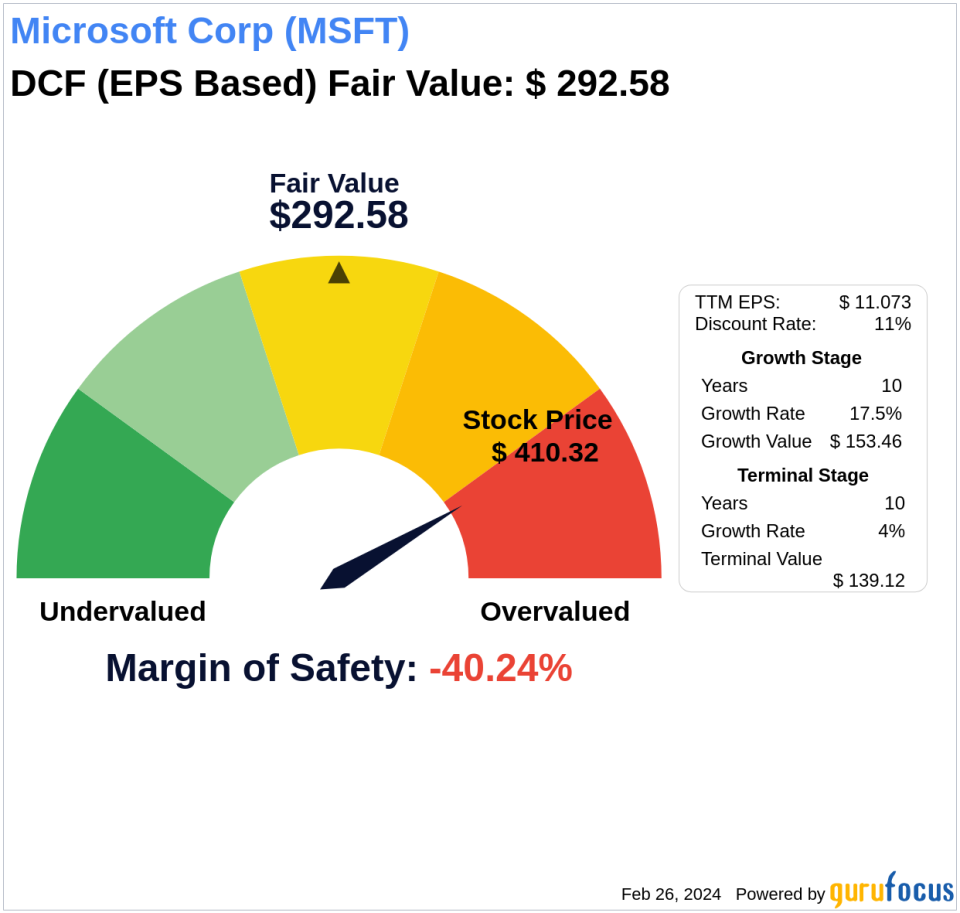

As of February 26, 2024, Microsoft Corp’s intrinsic value calculated by the discounted earnings model is $292.58. It is currently trading at $410.32. Therefore, the margin of safety based on the DCF model is -40.24%. The company is slightly overvalued.

model

GuruFocus DCF Calculator follows a two-stage model by default. This model consists of a growth phase and a terminal phase. In the growth stage, the company is growing faster, but in the terminal stage, a lower growth rate is applied as sustained rapid growth is not sustainable in the long run. Microsoft Corp’s intrinsic value, as estimated by the discounted earnings model, is derived by the following assumptions and steps.

assumption

|

semester |

value |

explanation |

|---|---|---|

|

EPS without NRI |

$11.07 |

The GuruFocus DCF Calculator uses EPS without NRI as a default because historically stock prices are more correlated with earnings than with free cash flow. |

|

Discount rate |

11% |

The appropriate discount rate is usually the risk-free rate plus the stock market risk premium. GuruFocus uses his current 10-year Treasury maturity rate of 4.24% and rounds it to the nearest whole number to be 5%. A 6% risk premium is then added to obtain the estimated discount rate. |

|

growth stage |

Growth rate (g1) = 17.50% Number of years in growth stage = 10 |

We select growth rates based on availability, prioritizing average EPS growth excluding NRI over the past 10, 5, or 3 years, in that order, to maintain a fair and balanced estimate.5 Set an upper limit between % and 20%. The default growth period is set to 10 years. |

|

terminal stage |

Growth rate (g2) = 4% Number of terminal years = 10 |

At the terminal stage, eps grows at 4% for 10 years. It is important to ensure that the terminal growth rate remains lower than the discount rate to facilitate convergence of the calculations. |

calculation

|

growth stage |

= |

EPS without NRI |

* |

[ (1 + g1) / (1 + d) |

* |

(1 + g1) ^ 2 / (1 + d) ^ 2 |

+ |

… |

+ |

(1 + g1) ^ 10 / (1 + d) ^ 10 ] |

||

|

= |

153.46 |

|||||||||||

|

terminal stage |

= |

EPS without NRI |

* |

(1 + g1) ^ 10 / (1 + d) ^ 10 |

* |

[ (1 + g2) / (1 + d) |

+ |

(1 + g2) ^ 2 / (1 + d) ^ 2 |

+ |

… |

+ |

(1 + g2) ^ 10 / (1 + d) ^ 10 ] |

|

= |

139.12 |

|||||||||||

|

Intrinsic value: DCF (revenue-based) |

= |

growth stage |

+ |

terminal stage |

= |

292.58 |

||||||

Discounted free cash flow model

GuruFocus also provides calculations using the traditional approach of free cash flow. Using trailing twelve months (ttm) free cash flow per share as a parameter, the intrinsic value of DCF based on free cash flow is $175.45. This valuation indicates that Microsoft Corp is significantly overvalued, with a margin of safety of -133.87%. On the DCF calculation page, you can always switch to using free cash flow per share to calculate his actual DCF model.

conclusion

Please note that while the DCF model is a robust valuation technique, it relies on various assumptions and projections that can affect the accuracy of the final intrinsic value calculation. Here are some considerations when adopting the DCF model.

-

Future earning potential: The DCF model values companies based on their future earnings potential.

-

Embrace growth: Growth plays a vital role. All else being equal, fast-growing companies are worth more.

-

Predictability: This model is more suitable for companies with consistent performance, as it assumes that the company will grow at the same rate as its performance over the past 10 years. For companies with unpredictable performance, such as cyclical companies, a DCF model may be less accurate and should emphasize a larger margin of safety.

-

Discount rate: Choosing the appropriate discount rate is most important. A wise choice is to use the expected return on investment to calculate the discount rate.

Navigation using GuruFocus:

GuruFocus All-in-One Screener allows you to easily screen for stocks that are currently trading below their intrinsic value (DCF (based on FCF)) and below their intrinsic value (DCF (based on earnings)). To identify undervalued and predictable companies, look at the predictability ranks that are trading at a discount to Intrinsic Value: DCF (based on FCF) and Intrinsic Value: DCF (based on earnings). Focus on high value companies.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.