Over the past six months, markets have been so obsessed with when the Fed will make its first rate cut that no one has even considered the unthinkable: what would happen if they didn’t cut rates at all in 2024. There wasn’t.

Until about a month ago, there was still a chance that the first rate cut would happen in March, around 3/1. This is now almost certainly ruled out, with the first bear market likely to focus on May or June.

However, following January’s sluggish consumer price inflation, better-than-expected labor market data, and subsequent hawkish comments from the Fed at its previous Open Market Committee meeting, some are pushing back their expectations to the July meeting. This is a factor pushing them back.

And what if, some time from now, the inflation data starts to get more sticky? There are many outliers that have not yet appeared in the official data.

Supply chain and wage increase risks

Abnormal values include the effects of longer lead times and higher transportation costs for products and raw materials, as cargo avoids the Red Sea, resulting in longer transportation routes.

“Tensions in the Red Sea are starting to impact freight rates and could lead to pressures across the supply chain, which was a key driver of the inflation spike in 2022,” said World Gold Council strategist Jeremy de Pessemier. “There is,” he said.

Wage inflation could also pose an unusual risk as the labor market remains tight, with strong job creation and low levels of layoffs continuing into what would have been the second half of the current economic cycle. be.

Bank of America analyst Claudio Irigoyen said: “If labor demand remains strong on the back of strong nominal spending, nominal wages could rise non-linearly, spurring services inflation.” There is,” he said.

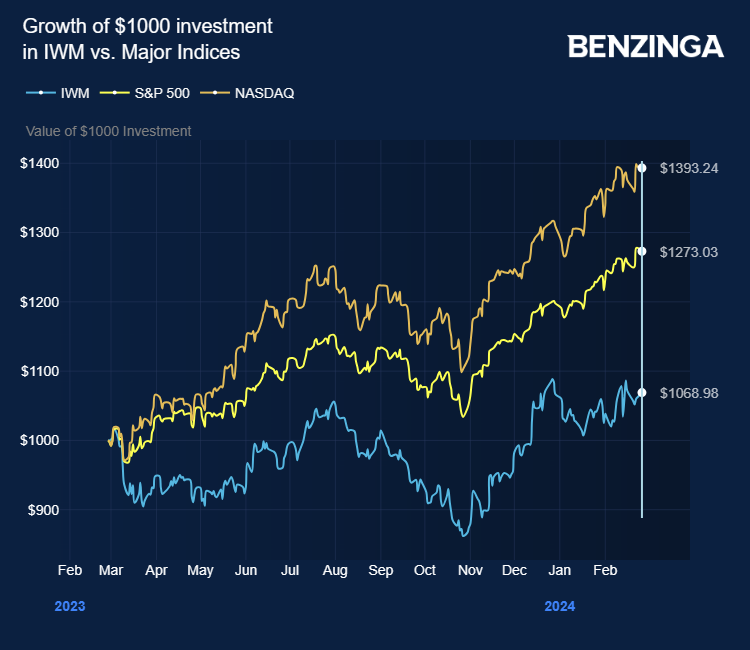

The graph above is iShares Russell 2000 ETF against both the S&P 500 and Nasdaq indices.

Also Read: Fed Minutes Increase Warning on Inflation, Reversing Move to Cut Early Interest Rates

Despite these uncertainties, including fiscal policy challenges that have caused the government to repeatedly postpone the federal budget and a looming presidential election, the economy is far more resilient than many expected six months ago. It has been proven that there is.

“The path back to the inflation target was always likely to be as bumpy and narrow as the path to a soft landing,” de Pessemier said.

Markets are still pricing in several rate cuts in 2024 and further cuts in 2025, but given potential external threats, the risk of a surprise of further rise in inflation cannot be ruled out. Can not.

“Markets can be wrong, as well as completely underestimating inflation and overestimating economic slowdown. And to be fair, the Fed also delayed its tightening cycle by a year. So we were in the same camp,” Yrigoyen said.

Meanwhile, a recent National Federation of Independent Business survey of small businesses asked 10,000 businesses whether they planned to raise selling prices over the next three months.

“The recent acceleration in the proportion of companies saying yes suggests that CPI inflation is likely to rise over the coming months,” said Thorsten Slok, chief economist at Apollo Global Management. ” he said.

How will the market react?

So what does this mean for the market? If the Fed delays rate cuts further beyond May and June, stock market gains could weaken and reverse.

This is likely to be driven by losses for small and mid-cap stocks that need loans for growth opportunities, and the longer interest rates remain high, the harder it will be to repay them.

of iShares Russell 2000 ETF Exchange-traded funds (NYSE: IWM) that track small-cap stocks have stalled in 2024 after two strong months in November and December, when expectations for a March rate cut remained high.

High-debt tech stocks and companies that don’t pay dividends could also bear the brunt of the decline.Magnificent Seven stocks, etc. NVIDIA Corporation (NASDAQ:NVDA) and Meta Platforms Co., Ltd. (NASDAQ:META) has been at the forefront of the rally, but could be hit by profit-taking.

The dollar, which strengthened in 2024 as expectations for a March interest rate cut faded, will be further supported if expectations for a rate cut are prolonged.of Invesco Dollar Index Bullish Fund (NYSE:UUP) is up 3.3% year to date in 2024.

A strong dollar is generally negative for gold. The higher the U.S. currency rate, the more expensive it will be to buy dollar-denominated gold in another currency. After surging to record highs in December, gold prices have ranged widely between the $2,000 and $2,100 levels.of SPDR Gold Stock ETF (NYSE:GLD) tracked this performance.

Oil markets tend to react to broader economic trends and geopolitics. Therefore, if the consumption environment becomes more difficult due to rising inflation and demand declines, prices will be hit. Such considerations are currently balanced by potential geopolitical developments in the Middle East and Russia/Ukraine.

of US Oil Fund ETF (NYSE:USO) is up nearly 10% so far in 2024.

Read now: Biden calls for budget juggernaut: But what if a government shutdown is inevitable?

Photo: Shutterstock