When buying shares in a company, it’s worth bearing in mind that the company could fail and you could lose money. But on the bright side, if you buy stocks in high-quality companies at the right price, you can earn well over 100%.long term Amazon.com Inc. (NASDAQ:AMZN) stock price is up 109% in five years, so shareholders would be well aware of this. It’s also good to see that the stock price is up 19% quarter-over-quarter. However, this could be related to the strong market, which is up 12% over the past three months.

On the back of a solid seven-day performance, let’s take a look at how the company’s fundamentals have played a role in driving long-term shareholder returns.

Check out our latest analysis for Amazon.com.

To paraphrase Benjamin Graham, in the short term the market is a voting machine, but in the long term it is a weighing machine. One way he looks at how market sentiment has changed over time is to look at the interaction between a company’s stock price and his earnings per share (EPS).

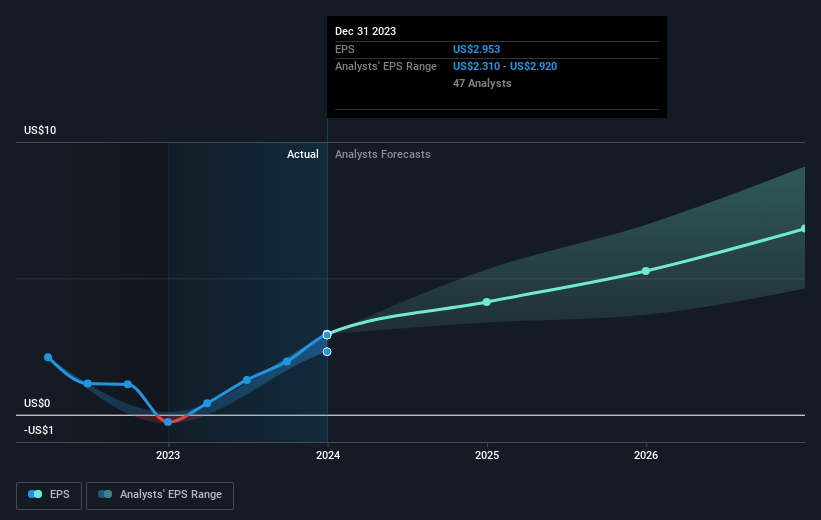

During five years of stock price growth, Amazon.com went from a loss to a profit. In some cases, the start of profitability can be a major inflection point, signaling rapid earnings growth going forward, which in turn justifies a significant increase in the stock price.

The image below shows how EPS has changed over time (unveil the exact values by clicking on the image).

We’re pleased to report that our CEO is paid more modestly than most CEOs at similarly capitalized companies. But while CEO pay is always worth checking, the really important question is whether the company can grow its earnings going forward. Before buying or selling a stock, it’s always a good idea to take a closer look at past growth trends. You can get it here.

different perspective

It’s good to see that Amazon.com shareholders received a total shareholder return of 87% last year. This growth rate is better than the five-year annual TSR (16%). So it seems like sentiment around the company has been positive lately. Optimists might think that the recent improvement in TSR indicates that the business itself is improving over time. Most investors take the time to review insider trading data. You can click here to see if insiders have been buying or selling.

of course, You may find a great investment by looking elsewhere. So take a look at this free A list of companies with expected revenue growth.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.