Warren Buffett famously said, “Volatility is not synonymous with risk.” It’s only natural to consider a company’s balance sheet when you consider how risky it is, since debt is often involved when a business collapses.I understand that Meta Platforms Co., Ltd. (NASDAQ:META) uses debt in its operations. But is this debt a concern for shareholders?

What risks does debt pose?

Generally, debt only becomes a real problem if a company cannot easily pay it off, either by raising capital or with its own cash flow. Ultimately, if a company fails to meet its legal obligations to repay debt, shareholders could walk away with nothing. But a more common (but still expensive) situation is when a company needs to dilute shareholders at a cheap share price just to manage its debt. However, as an alternative to dilution, debt can be a very good tool for companies that need capital to invest in growth at high rates of return. When we think about a company’s use of debt, we first think of cash and debt together.

Check out our latest analysis for MetaPlatform.

What is Meta Platforms’ net debt?

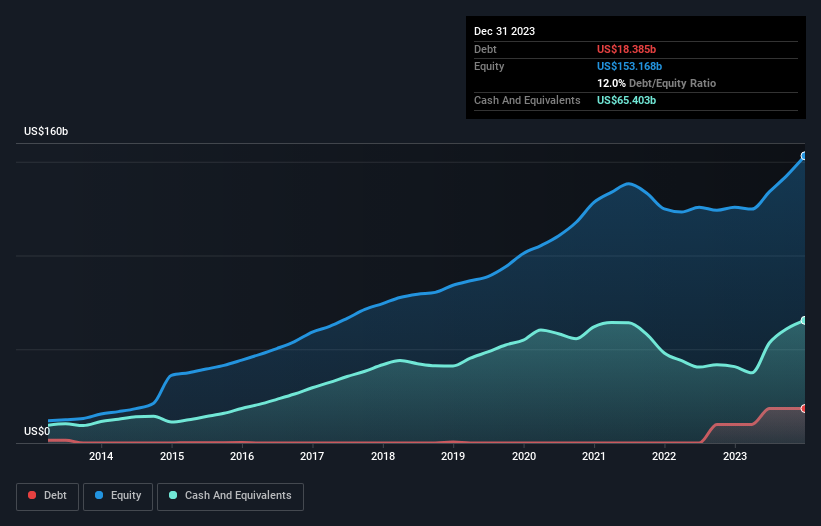

The graphic below, which you can click on for the historical numbers, shows that Meta Platforms had debt of US$18.4b at December 2023, up from US$9.92b over one year. However, it also held US$65.4b in cash offsetting this, meaning it had net cash of US$47.0b.

View Metaplatform Debt

Zooming in on the latest balance sheet data, we can see that Meta Platforms had debt of US$32.0b due within 12 months, and debt of US$44.5b due beyond that. Offsetting this, it had cash of US$65.4b and his receivables of US$16.2b due within 12 months. Therefore, the company can boast of his $5.12 billion more liquid assets than other companies. total liabilities.

This situation indicates that Meta Platforms has a very strong balance sheet, as its total debt is roughly equal to its current assets. So it’s highly unlikely that the US$1.23tn company is short on cash, but it’s still worth keeping an eye on its balance sheet. Simply put, Meta Platforms has net cash, so we can say it doesn’t have a lot of debt.

On top of that, Meta Platforms grew its EBIT by 46% in the last twelve months, and this growth helps manage its debt. When analyzing debt levels, the balance sheet is the obvious place to start. But ultimately, Metaplatform’s ability to strengthen its balance sheet over the long term will depend on the future profitability of the business.If you’re focused on the future, check this out free A report showing analyst profit forecasts.

Finally, while tax preparers may adore accounting profits, lenders only accept cold hard cash. Metaplatform may have net cash on its balance sheet, but it’s still interesting to note how well the company converts its earnings before interest and tax (EBIT) into free cash flow. This is because it affects both the company’s needs and its capabilities. To manage debt. Over the past three years, Meta Platforms generated solid free cash flow representing 79% of his EBIT. This is about as expected. This free cash flow puts the company in a good position to pay down debt as needed.

summary

While we sympathize with investors concerned about debt, they should keep in mind that Meta Platforms has net cash of US$47b, meaning it has more liquid assets than debt. And we’re impressed by the 46% growth in EBIT over the last year. Therefore, we don’t think Meta Platforms’ use of debt is risky. There’s no question that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet, far from it. For example, we discovered that 1 warning sign for Meta Platform What you need to know before investing here.

After all, it may be easier to focus on companies that don’t even need to take on debt.Readers can access a list of growth stocks with zero net debt completely freeright now.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.